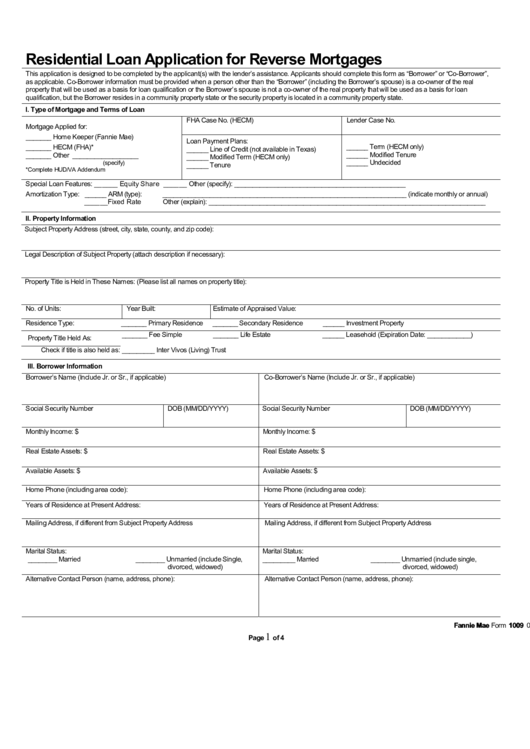

Residential Loan Application for Reverse Mortgages

This application is designed to be completed by the applicant(s) with the lender’s assistance. Applicants should complete this form as “Borrower” or “Co-Borrower”,

as applicable. Co-Borrower information must be provided when a person other than the “Borrower” (including the Borrower’s spouse) is a co-owner of the real

property that will be used as a basis for loan qualification or the Borrower’s spouse is not a co-owner of the real property that will be used as a basis for loan

qualification, but the Borrower resides in a community property state or the security property is located in a community property state.

I. Type of Mortgage and Terms of Loan

FHA Case No. (HECM)

Lender Case No.

Mortgage Applied for:

_______ Home Keeper (Fannie Mae)

Loan Payment Plans:

______ Term (HECM only)

_______ HECM (FHA)*

______ Line of Credit (not available in Texas)

_______ Other __________________

______ Modified Tenure

______ Modified Term (HECM only)

______ Undecided

(specify)

______ Tenure

*Complete HUD/VA Addendum

Special Loan Features: ______ Equity Share ______ Other (specify): _______________________________________________

Amortization Type: ______ ARM (type):

___________________________________________________________________ (indicate monthly or annual)

______Fixed Rate

Other (explain): ____________________________________________________________________________

II. Property Information

Subject Property Address (street, city, state, county, and zip code):

Legal Description of Subject Property (attach description if necessary):

Property Title is Held in These Names: (Please list all names on property title):

No. of Units:

Year Built:

Estimate of Appraised Value:

Residence Type:

_______ Primary Residence

_______ Secondary Residence

______ Investment Property

_______ Fee Simple

_______ Life Estate

______ Leasehold (Expiration Date: ____________)

Property Title Held As:

Check if title is also held as: _________ Inter Vivos (Living) Trust

III. Borrower Information

Borrower’s Name (Include Jr. or Sr., if applicable)

Co-Borrower’s Name (Include Jr. or Sr., if applicable)

Social Security Number

DOB (MM/DD/YYYY)

Social Security Number

DOB (MM/DD/YYYY)

Monthly Income: $

Monthly Income: $

Real Estate Assets: $

Real Estate Assets: $

Available Assets: $

Available Assets: $

Home Phone (including area code):

Home Phone (including area code):

Years of Residence at Present Address:

Years of Residence at Present Address:

Mailing Address, if different from Subject Property Address

Mailing Address, if different from Subject Property Address

Marital Status:

Marital Status:

________ Married

________ Unmarried (include Single,

_________ Married

________ Unmarried (include single,

divorced, widowed)

divorced, widowed)

Alternative Contact Person (name, address, phone):

Alternative Contact Person (name, address, phone):

Fannie Mae Form 1009 05/2004

1

Page

of 4

1

1 2

2 3

3 4

4