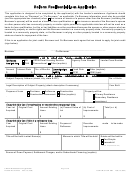

Instructions for completing the residential loan application for reverse mortgages

(Fannie Mae 1009) and Addendum

Social Security Number - Enter the applicant’s social security number, and co

applicant’s social security number, if applicable.

1. Instructions for completing the residential loan

application for reverse mortgages

Date of Birth - Enter the applicant’s birth date, and co-applicant’s birth date if,

applicable

For the borrower’s application for a Fannie Mae conventional reverse mortgage (Home

Monthly Income - Enter the applicant’s monthly income, and co-applicant’s monthly

Keeper Mortgage) or an FHA-insured reverse mortgage (Home Equity Conversion

income, if applicable.

Mortgage, or HECM), the lender has the option of using the Residential Loan Application

for Reverse Mortgage (Fannie Mae Form 1009) or the Uniform Residential Loan

Real Estate Assets - Enter total value of applicant’s real estate assets.

Application (Freddie Mac Form 65/Fannie Mae Form 1003).

Available Assets - Enter the amount of the applicant’s available (liquid) assets.

For both forms, if the mortgage applied for is a HECM, the HUD/VA Addendum (HUD

Home Phone - Enter the applicant’s home phone number, and co-applicant’s home

92900-A) must be completed.

phone number, if applicable. Include the area code for each phone number.

The Residential Loan Application for Reverse Mortgage, Fannie Mae Form 1009, must

Years of Residence at Present Address - Enter the number of years the applicant has

be completed as detailed below for the Home Keeper Mortgage or the HECM:

resided at the subject property address. Provide the same information for the coapplicant,

if applicable.

Section I. Type Of Mortgage And Terms Of Loan

Marital Status - Check box that represents the applicant’s marital status. If separated but

Mortgage Applied for - Check the type of reverse mortgage for which application is being

not divorce, the “Married” box should be selected. Provide the same information for the co-

made: Home Keeper, HECM, or Other type of reverse mortgage. If Other is selected, the

applicant, if applicable.

mortgage product must be specified. If HECM is selected, the HUD/VA Addendum must be

completed and attached to the application.

Alternative Contact Person - If the application is for a Home Keeper Mortgage, provide the

name, home address, and telephone number for a family member, friend, or advisor to the

FHA Case No. - If the mortgage applied for is a Home Keeper, this section should be left

applicant. The contact person should be someone who has access to and/or maintains

blank. If the mortgage applied for is a HECM, the FHA case number should be entered

regular communication with the applicant. Provide the same information for the co-

followed by the appropriate Section of the Act ADP Code for HECMs listed below:

applicant, if applicable. (This information is optional for the HECM loan.)

HUD-Processed

Direct

Endorsement

Section IV. Liens Against The Property

Assignment/Fixed-rate

911

951

The applicant must provide information on unpaid liens against the property. The name

Assignment/Adjustable-rate

912

952

and address of the creditor(s), as well as the lien account number(s) and balance(s)

Shared Premium/Fixed-rate

913

953

owed, must be completed. The total unpaid balance of these property liens should be

Shared Premium/ARM

914

954

totaled and entered in the space provided.

Shared Appreciation/Fixed-rate

915

955

Shared Appreciation/ARM

916

956

Section V. Non-real Estate Debts

Condo (Fixed)

917

957

List the total of all debts not related to real estate.

Condo (ARM)

918

958

Section VI. Declarations

Lender Case No. - Indicate the case number assigned by the lender. This case number

The applicant and co-applicant, if applicable, must complete blocks a. through f., using

can be any combination of letters and numbers, as determined by the lender.

“Yes” or “No” as responses. Block d. requires a detailed explanation if the response is

Loan Payment Plans - Indicate the payment plan in which the applicant is interested. The

affirmative. Blocks f., g., and h. are not required for HECM application.

applicant can change the payment plan selection at closing.

Section VII. Acknowledgment and Agreement

Special Loan Features - The Equity Share Option is only available under the Home

The applicant and co-applicant, if applicable, should read this section carefully,

Keeper Mortgage. Other special loan features pertaining to specific reverse mortgage

indicate the date of signature, and sign in the pertinent blocks.

products must be detailed in the space provided.

Section VIII. Information For Government Monitoring Purposes

Amortization Type - Indicate either fixed-rate or adjustable-rate (ARM) amortization. If ARM

These blocks may be completed. If the borrower chooses not to furnish any or all of this

is selected, indicate if the adjustment will occur monthly or annually.

information, Federal Regulations require that the lender note that choice on the

Section II. Property Information

application. Federal Regulations also require the lender to note the race or national origin

and sex of the applicant on the basis of visual observation or surname. This information

Subject Property Address - The address of the applicant’s primary residence–

is collected, in part, for the Home Mortgage Disclosure Act (HMDA).

including the county name and the zip code–should be entered.

Legal Description of Subject Property - Enter the legal description of the property as

2. Instructions for completing the HUD/VA Addendum

shown on the title insurance commitment or survey. The legal description may be attached

(Form (92900-A)

to the loan application if it is lengthy.

The HUD/VA Addendum (92900-A) consists of five (5) pages, the first four of which must

No. of Units - Enter the number of family units on the subject property. For example, “1”

be completed. These four pages contain statutory and regulatory information and

would be used to indicate a single-family property. “2” would indicate a duplex, etc.

certifications and should be completed, signed, and dated, and included in the case

Year Built - Indicate the year the property was constructed.

binder. For lenders who are not approved for direct endorsement or have preclosing

status, the documentation should be completed, signed and included in the case binder at

Estimate of Appraised Value - Enter an estimate of the property value. (An exact

valuation is not necessary as verification will occur during the property appraisal

the time of submission for firm commitment. Page five may be omitted since it is the

process.)

Veteran’s Administration Commitment for Guaranty and is not applicable. A copy of the

Addendum must be provided to the borrower. The instructions listed below relate to

Residence Type - Primary residence must be checked. Check “primary residence” and

completing the Addendum for the HECM Program.

“investment property” if applicant resides in a multi-unit property with rental tenants.

Property Title is Held in These Names - List names of all titleholders to the property.

PART I - Identifying Information

Property Title Held As - Identify how the property rights are held: fee simple, life estate, or

Section of the Act (Block 4) - Enter the same code that follows the FHA case

leasehold estate. If leasehold estate is selected, enter the expiration date of the lease. If

number in Section 1 of the loan application.

title is also held as an inter vivos (living) trust, check the corresponding box.

Loan Amount (Block 7) - The principal limit should be entered in this block

Section III. Borrower Information

Interest Rate (Block 8) - The Expected Average Mortgage Interest Rate (“expected rate”)

Borrower’s Name - Indicate the full legal name of the applicant, as the titleholder to the

should be entered in the block.

subject property.

Blocks 9, 10, 12a., 12b., and 20 should not be completed.

Co-Borrower’s Name - Indicate the full legal name of the co-applicant, if also a

titleholder to the subject property.

Fannie Mae Form 1009 05/2004

4

Page

of 4

1

1 2

2 3

3 4

4