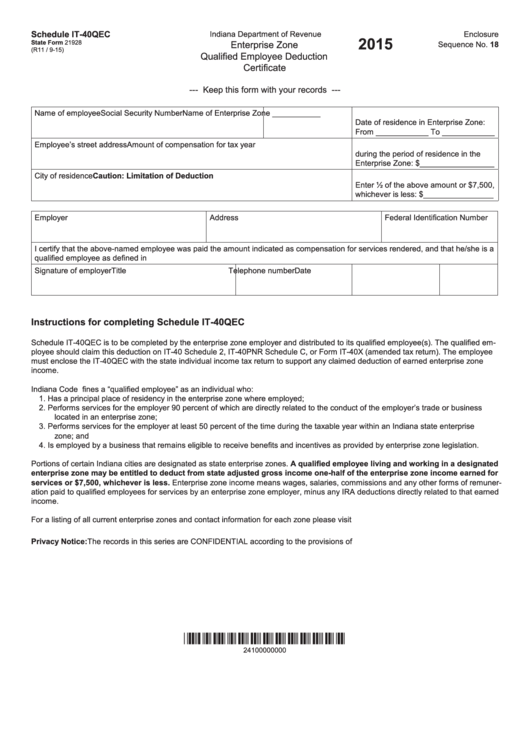

Schedule IT-40QEC

Indiana Department of Revenue

Enclosure

2015

State Form 21928

Enterprise Zone

Sequence No. 18

(R11 / 9-15)

Qualified Employee Deduction

Certificate

--- Keep this form with your records ---

Name of employee

Social Security Number Name of Enterprise Zone ___________

Date of residence in Enterprise Zone:

From ____________ To ____________

Employee’s street address

Amount of compensation for tax year

during the period of residence in the

Enterprise Zone: $_________________

City of residence

Caution: Limitation of Deduction

Enter ½ of the above amount or $7,500,

whichever is less: $________________

Employer

Address

Federal Identification Number

I certify that the above-named employee was paid the amount indicated as compensation for services rendered, and that he/she is a

qualified employee as defined in I.C. 6-3-2-8.

Signature of employer

Title

Telephone number

Date

Instructions for completing Schedule IT-40QEC

Schedule IT-40QEC is to be completed by the enterprise zone employer and distributed to its qualified employee(s). The qualified em-

ployee should claim this deduction on IT-40 Schedule 2, IT-40PNR Schedule C, or Form IT-40X (amended tax return). The employee

must enclose the IT-40QEC with the state individual income tax return to support any claimed deduction of earned enterprise zone

income.

Indiana Code I.C. 6-3-2-8 defines a “qualified employee” as an individual who:

1.

Has a principal place of residency in the enterprise zone where employed;

2.

Performs services for the employer 90 percent of which are directly related to the conduct of the employer’s trade or business

located in an enterprise zone;

3.

Performs services for the employer at least 50 percent of the time during the taxable year within an Indiana state enterprise

zone; and

4.

Is employed by a business that remains eligible to receive benefits and incentives as provided by enterprise zone legislation.

Portions of certain Indiana cities are designated as state enterprise zones. A qualified employee living and working in a designated

enterprise zone may be entitled to deduct from state adjusted gross income one-half of the enterprise zone income earned for

services or $7,500, whichever is less. Enterprise zone income means wages, salaries, commissions and any other forms of remuner-

ation paid to qualified employees for services by an enterprise zone employer, minus any IRA deductions directly related to that earned

income.

For a listing of all current enterprise zones and contact information for each zone please visit

Privacy Notice: The records in this series are CONFIDENTIAL according to the provisions of I.C. 6-8.1-7-1 and I.C. 5-28-15-8

*24100000000*

24100000000

1

1