Minnesota Tax Court Form 1 - Notice Of Appeal Of An Order Of The Commmissioner Of Revenue

ADVERTISEMENT

Last revised 7/2009

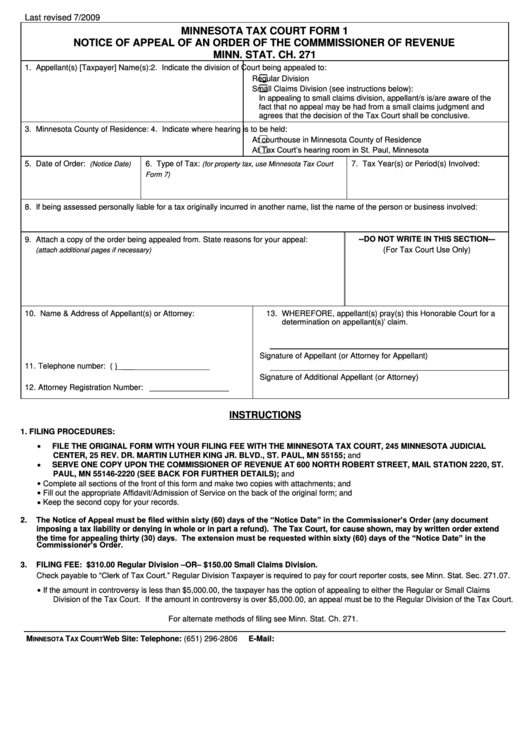

MINNESOTA TAX COURT FORM 1

NOTICE OF APPEAL OF AN ORDER OF THE COMMMISSIONER OF REVENUE

MINN. STAT. CH. 271

1. Appellant(s) [Taxpayer] Name(s):

2. Indicate the division of Court being appealed to:

Regular Division

Small Claims Division (see instructions below):

In appealing to small claims division, appellant/s is/are aware of the

fact that no appeal may be had from a small claims judgment and

agrees that the decision of the Tax Court shall be conclusive.

3. Minnesota County of Residence:

4. Indicate where hearing is to be held:

At courthouse in Minnesota County of Residence

At Tax Court’s hearing room in St. Paul, Minnesota

5. Date of Order:

6. Type of Tax:

7. Tax Year(s) or Period(s) Involved:

(Notice Date)

(for property tax, use Minnesota Tax Court

Form 7)

8. If being assessed personally liable for a tax originally incurred in another name, list the name of the person or business involved:

--DO NOT WRITE IN THIS SECTION-–

9. Attach a copy of the order being appealed from. State reasons for your appeal:

(For Tax Court Use Only)

(attach additional pages if necessary)

10. Name & Address of Appellant(s) or Attorney:

13. WHEREFORE, appellant(s) pray(s) this Honorable Court for a

determination on appellant(s)’ claim.

Signature of Appellant (or Attorney for Appellant)

11. Telephone number: (

) ____________________

Signature of Additional Appellant (or Attorney)

12. Attorney Registration Number: __________________

INSTRUCTIONS

1.

FILING PROCEDURES:

FILE THE ORIGINAL FORM WITH YOUR FILING FEE WITH THE MINNESOTA TAX COURT, 245 MINNESOTA JUDICIAL

CENTER, 25 REV. DR. MARTIN LUTHER KING JR. BLVD., ST. PAUL, MN 55155; and

SERVE ONE COPY UPON THE COMMISSIONER OF REVENUE AT 600 NORTH ROBERT STREET, MAIL STATION 2220, ST.

PAUL, MN 55146-2220 (SEE BACK FOR FURTHER DETAILS); and

Complete all sections of the front of this form and make two copies with attachments; and

Fill out the appropriate Affidavit/Admission of Service on the back of the original form; and

Keep the second copy for your records.

The Notice of Appeal must be filed within sixty (60) days of the “Notice Date” in the Commissioner’s Order (any document

2.

imposing a tax liability or denying in whole or in part a refund). The Tax Court, for cause shown, may by written order extend

the time for appealing thirty (30) days. The extension must be requested within sixty (60) days of the “Notice Date” in the

Commissioner’s Order.

FILING FEE: $310.00 Regular Division –OR– $150.00 Small Claims Division.

3.

Check payable to “Clerk of Tax Court.” Regular Division Taxpayer is required to pay for court reporter costs, see Minn. Stat. Sec. 271.07.

If the amount in controversy is less than $5,000.00, the taxpayer has the option of appealing to either the Regular or Small Claims

Division of the Tax Court. If the amount in controversy is over $5,000.00, an appeal must be to the Regular Division of the Tax Court.

For alternate methods of filing see Minn. Stat. Ch. 271.

M

T

C

Web Site:

Telephone: (651) 296-2806

E-Mail: info@taxcourt.state.mn.us

INNESOTA

AX

OURT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2