Application For Alternate Payee Benefits Pursuant To A Qualified Domestic Relations Order - Massachusetts Laborers' Annuity Fund

ADVERTISEMENT

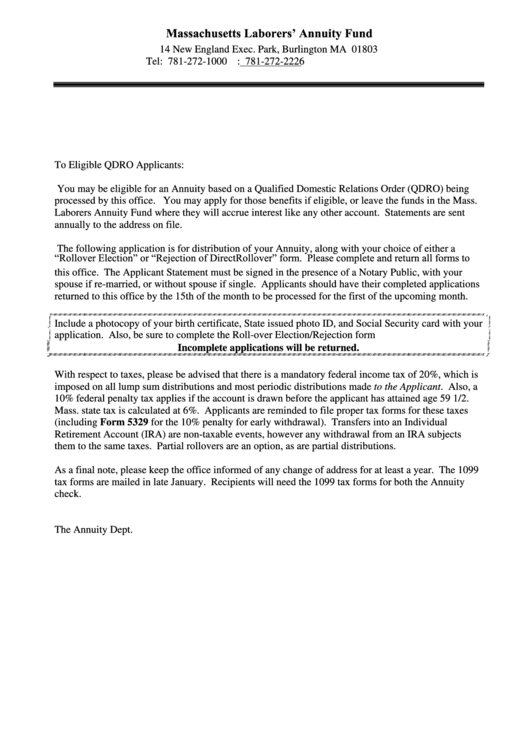

Massachusetts Laborers’ Annuity Fund

14 New England Exec. Park, Burlington MA 01803

Tel: 781-272-1000 Fax: 781-272-2226

To Eligible QDRO Applicants:

You may be eligible for an Annuity based on a Qualified Domestic Relations Order (QDRO) being

processed by this office. You may apply for those benefits if eligible, or leave the funds in the Mass.

Laborers Annuity Fund where they will accrue interest like any other account. Statements are sent

annually to the address on file.

The following application is for distribution of your Annuity, along with your choice of either a

“Rollover Election” or “Rejection of Direct Rollover” form. Please complete and return all forms to

this office. The Applicant Statement must be signed in the presence of a Notary Public, with your

spouse if re-married, or without spouse if single. Applicants should have their completed applications

returned to this office by the 15th of the month to be processed for the first of the upcoming month.

Include a photocopy of your birth certificate, State issued photo ID, and Social Security card with your

application. Also, be sure to complete the Roll-over Election/Rejection form

Incomplete applications will be returned.

With respect to taxes, please be advised that there is a mandatory federal income tax of 20%, which is

imposed on all lump sum distributions and most periodic distributions made to the Applicant. Also, a

10% federal penalty tax applies if the account is drawn before the applicant has attained age 59 1/2.

Mass. state tax is calculated at 6%. Applicants are reminded to file proper tax forms for these taxes

(including Form 5329 for the 10% penalty for early withdrawal). Transfers into an Individual

Retirement Account (IRA) are non-taxable events, however any withdrawal from an IRA subjects

them to the same taxes. Partial rollovers are an option, as are partial distributions.

As a final note, please keep the office informed of any change of address for at least a year. The 1099

tax forms are mailed in late January. Recipients will need the 1099 tax forms for both the Annuity

check.

The Annuity Dept.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3