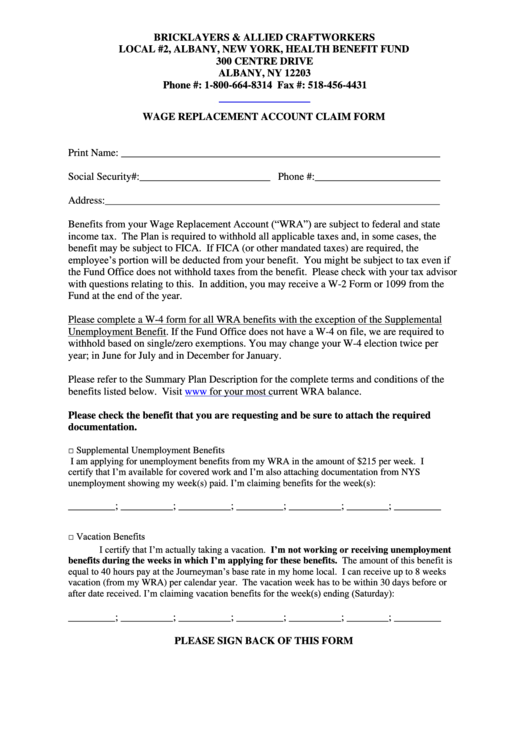

Wage Replacement Account Claim Form

ADVERTISEMENT

BRICKLAYERS & ALLIED CRAFTWORKERS

LOCAL #2, ALBANY, NEW YORK, HEALTH BENEFIT FUND

300 CENTRE DRIVE

ALBANY, NY 12203

Phone #: 1-800-664-8314 Fax #: 518-456-4431

WAGE REPLACEMENT ACCOUNT CLAIM FORM

Print Name: _____________________________________________________________

Social Security#:_________________________ Phone #:________________________

Address:________________________________________________________________

Benefits from your Wage Replacement Account (“WRA”) are subject to federal and state

income tax. The Plan is required to withhold all applicable taxes and, in some cases, the

benefit may be subject to FICA. If FICA (or other mandated taxes) are required, the

employee’s portion will be deducted from your benefit. You might be subject to tax even if

the Fund Office does not withhold taxes from the benefit. Please check with your tax advisor

with questions relating to this. In addition, you may receive a W-2 Form or 1099 from the

Fund at the end of the year.

Please complete a W-4 form for all WRA benefits with the exception of the Supplemental

Unemployment Benefit. If the Fund Office does not have a W-4 on file, we are required to

withhold based on single/zero exemptions. You may change your W-4 election twice per

year; in June for July and in December for January.

Please refer to the Summary Plan Description for the complete terms and conditions of the

benefits listed below. Visit

for your most current WRA balance.

Please check the benefit that you are requesting and be sure to attach the required

documentation.

□ Supplemental Unemployment Benefits

I am applying for unemployment benefits from my WRA in the amount of $215 per week. I

certify that I’m available for covered work and I’m also attaching documentation from NYS

unemployment showing my week(s) paid. I’m claiming benefits for the week(s):

_________; __________; __________; _________; __________; ________; _________

□ Vacation Benefits

I certify that I’m actually taking a vacation. I’m not working or receiving unemployment

benefits during the weeks in which I’m applying for these benefits. The amount of this benefit is

equal to 40 hours pay at the Journeyman’s base rate in my home local. I can receive up to 8 weeks

vacation (from my WRA) per calendar year. The vacation week has to be within 30 days before or

after date received. I’m claiming vacation benefits for the week(s) ending (Saturday):

_________; __________; __________; _________; __________; ________; _________

PLEASE SIGN BACK OF THIS FORM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2