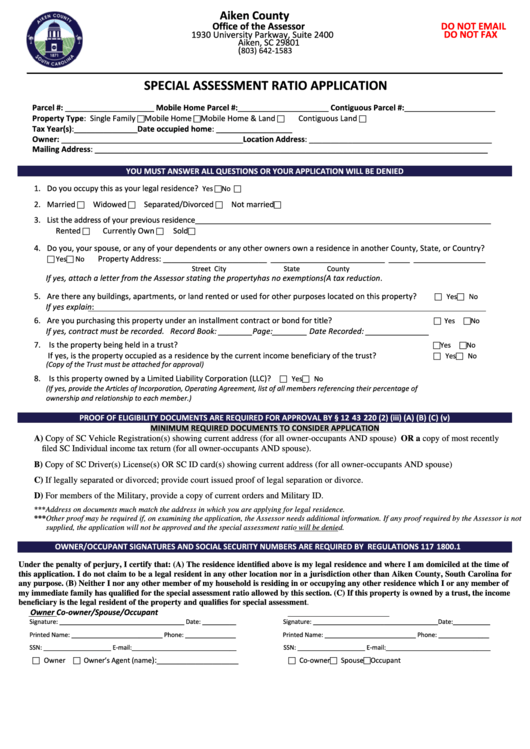

Aiken County

Office of the Assessor

DO NOT EMAIL

DO NOT FAX

1930 University Parkway, Suite 2400

Aiken, SC 29801

(

803) 642-1583

assessor@aikencountysc.gov

____________________________________________________________________________________________

SPECIAL ASSESSMENT RATIO APPLICATION

Parcel #: _____________________ Mobile Home Parcel #:_____________________ Contiguous Parcel #:_____________________

Property Type: Single Family

Mobile Home

Mobile Home & Land

Contiguous Land

Tax Year(s):_______________Date occupied home: __________________

Owner: ___________________________________________Location Address: ___________________________________________

Mailing Address: _____________________________________________________________________________________________

YOU MUST ANSWER ALL QUESTIONS OR YOUR APPLICATION WILL BE DENIED

1. Do you occupy this as your legal residence?

Yes

No

2. Married

Widowed

Separated/Divorced

Not married

3. List the address of your previous residence______________________________________________________________________

Rented

Currently Own

Sold

4. Do you, your spouse, or any of your dependents or any other owners own a residence in another County, State, or Country?

Property Address: ________________________ ___________________________ _____ _________________

Yes

No

Street

City

State

County

If yes, attach a letter from the Assessor stating the property has no exemptions(A tax reduction.

5. Are there any buildings, apartments, or land rented or used for other purposes located on this property?

Yes

No

If yes explain:

6. Are you purchasing this property under an installment contract or bond for title?

Yes

No

If yes, contract must be recorded. Record Book: ________Page:________ Date Recorded: _______________

7. Is the property being held in a trust?

Yes

No

If yes, is the property occupied as a residence by the current income beneficiary of the trust?

Yes

No

(Copy of the Trust must be attached for approval)

8. Is this property owned by a Limited Liability Corporation (LLC)?

Yes

No

(If yes, provide the Articles of Incorporation, Operating Agreement, list of all members referencing their percentage of

ownership and relationship to each member.)

PROOF OF ELIGIBILITY DOCUMENTS ARE REQUIRED FOR APPROVAL BY § 12 - 43 - 220 (2) (iii) (A) (B) (C) (v)

MINIMUM REQUIRED DOCUMENTS TO CONSIDER APPLICATION

A) Copy of SC Vehicle Registration(s) showing current address (for all owner-occupants AND spouse) OR a copy of most recently

filed SC Individual income tax return (for all owner-occupants AND spouse).

B) Copy of SC Driver(s) License(s) OR SC ID card(s) showing current address (for all owner-occupants AND spouse)

C) If legally separated or divorced; provide court issued proof of legal separation or divorce.

D) For members of the Military, provide a copy of current orders and Military ID.

***Address on documents much match the address in which you are applying for legal residence.

***Other proof may be required if, on examining the application, the Assessor needs additional information. If any proof required by the Assessor is not

supplied, the application will not be approved and the special assessment ratio will be denied.

OWNER/OCCUPANT SIGNATURES AND SOCIAL SECURITY NUMBERS ARE REQUIRED BY S.C. REGULATIONS 117 - 1800.1

Under the penalty of perjury, I certify that: (A) The residence identified above is my legal residence and where I am domiciled at the time of

this application. I do not claim to be a legal resident in any other location nor in a jurisdiction other than Aiken County, South Carolina for

any purpose. (B) Neither I nor any other member of my household is residing in or occupying any other residence which I or any member of

my immediate family has qualified for the special assessment ratio allowed by this section. (C) If this property is owned by a trust, the income

beneficiary is the legal resident of the property and qualifies for special assessment.

Owner

Co-owner/Spouse/Occupant

Signature: _____________________________________ Date: __________

Signature: _____________________________________Date:___________

Printed Name: ___________________________ Phone: _______________

Printed Name: ___________________________ Phone: _______________

SSN: ____________________ E-mail:_______________________________

SSN: ____________________ E-mail:_______________________________

):___________________

Owner

Owner’s Agent (name

Co-owner

Spouse

Occupant

1

1 2

2