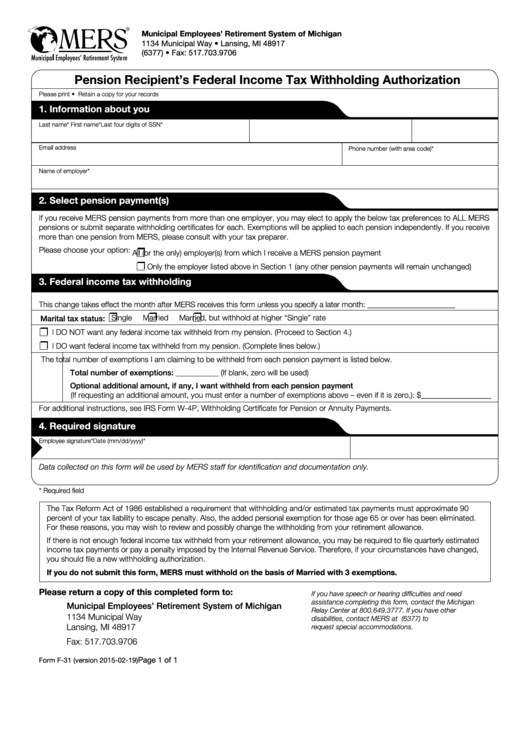

Municipal Employees’ Retirement System of Michigan

1134 Municipal Way • Lansing, MI 48917

800.767.MERS (6377) • Fax: 517.703.9706

Pension Recipient’s Federal Income Tax Withholding Authorization

Please print • Retain a copy for your records

1. Information about you

Last four digits of SSN*

Last name*

First name*

Email address

Phone number (with area code)*

Name of employer*

2. Select pension payment(s)

If you receive MERS pension payments from more than one employer, you may elect to apply the below tax preferences to ALL MERS

pensions or submit separate withholding certificates for each. Exemptions will be applied to each pension independently. If you receive

more than one pension from MERS, please consult with your tax preparer.

Please choose your option:

All (or the only) employer(s) from which I receive a MERS pension payment

Only the employer listed above in Section 1 (any other pension payments will remain unchanged)

3. Federal income tax withholding

This change takes effect the month after MERS receives this form unless you specify a later month: _______________________

Single

Married

Married, but withhold at higher “Single” rate

Marital tax status:

I DO NOT want any federal income tax withheld from my pension. (Proceed to Section 4.)

I DO want federal income tax withheld from my pension. (Complete lines below.)

The total number of exemptions I am claiming to be withheld from each pension payment is listed below.

Total number of exemptions: ___________ (If blank, zero will be used)

Optional additional amount, if any, I want withheld from each pension payment

(If requesting an additional amount, you must enter a number of exemptions above – even if it is zero.): $__________________

For additional instructions, see IRS Form W-4P, Withholding Certificate for Pension or Annuity Payments.

4. Required signature

Employee signature*

Date (mm/dd/yyyy)*

Data collected on this form will be used by MERS staff for identification and documentation only.

* Required field

The Tax Reform Act of 1986 established a requirement that withholding and/or estimated tax payments must approximate 90

percent of your tax liability to escape penalty. Also, the added personal exemption for those age 65 or over has been eliminated.

For these reasons, you may wish to review and possibly change the withholding from your retirement allowance.

If there is not enough federal income tax withheld from your retirement allowance, you may be required to file quarterly estimated

income tax payments or pay a penalty imposed by the Internal Revenue Service. Therefore, if your circumstances have changed,

you should file a new withholding authorization.

If you do not submit this form, MERS must withhold on the basis of Married with 3 exemptions.

Please return a copy of this completed form to:

If you have speech or hearing difficulties and need

assistance completing this form, contact the Michigan

Municipal Employees’ Retirement System of Michigan

Relay Center at 800.649.3777. If you have other

1134 Municipal Way

disabilities, contact MERS at 800.767.MERS (6377) to

Lansing, MI 48917

request special accommodations.

Fax: 517.703.9706

Page 1 of 1

Form F-31 (version 2015-02-19)

1

1