Form W-9 - Taxpayer Identification Number Request - Baruch College

ADVERTISEMENT

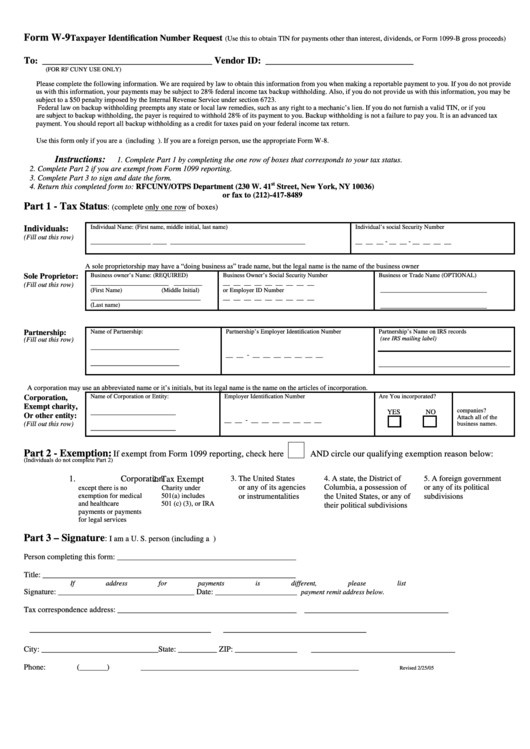

Form W-9

Taxpayer Identification Number Request

(Use this to obtain TIN for payments other than interest, dividends, or Form 1099-B gross proceeds)

To

Vendor ID:

: _______________________________________

__________________________________

(FOR RF CUNY USE ONLY)

Please complete the following information. We are required by law to obtain this information from you when making a reportable payment to you. If you do not provide

us with this information, your payments may be subject to 28% federal income tax backup withholding. Also, if you do not provide us with this information, you may be

subject to a $50 penalty imposed by the Internal Revenue Service under section 6723.

Federal law on backup withholding preempts any state or local law remedies, such as any right to a mechanic’s lien. If you do not furnish a valid TIN, or if you

are subject to backup withholding, the payer is required to withhold 28% of its payment to you. Backup withholding is not a failure to pay you. It is an advanced tax

payment. You should report all backup withholding as a credit for taxes paid on your federal income tax return.

Use this form only if you are a U.S. person (including U.S. resident alien). If you are a foreign person, use the appropriate Form W-8.

Instructions:

1. Complete Part 1 by completing the one row of boxes that corresponds to your tax status.

2. Complete Part 2 if you are exempt from Form 1099 reporting.

3. Complete Part 3 to sign and date the form.

st

4. Return this completed form to: RFCUNY/OTPS Department (230 W. 41

Street, New York, NY 10036)

or fax to (212)-417-8489

Part 1 - Tax Status

:

(complete only one row of boxes)

Individual Name: (First name, middle initial, last name)

Individual’s social Security Number

Individuals:

(Fill out this row)

_________________ ____ ______________________________________

__ __ __ - __ __ - __ __ __ __

A sole proprietorship may have a “doing business as” trade name, but the legal name is the name of the business owner

Business owner’s Name: (REQUIRED)

Business Owner’s Social Security Number

Business or Trade Name (OPTIONAL)

Sole Proprietor:

______________________ ________

__ __ __ __ __ __ __ __ __

(Fill out this row)

______________________________

(First Name)

(Middle Initial)

or Employer ID Number

_______________________________

__ __ __ __ __ __ __ __ __

(Last name)

______________________________

Name of Partnership:

Partnership’s Employer Identification Number

Partnership’s Name on IRS records

Partnership:

(see IRS mailing label)

(Fill out this row)

_________________________

__ __ - __ __ __ __ __ __ __

_________________________

_____________________________________

A corporation may use an abbreviated name or it’s initials, but its legal name is the name on the articles of incorporation.

Name of Corporation or Entity:

Employer Identification Number

Are You incorporated?

Corporation,

D.B.A or T.A.

Exempt charity,

companies?

________________________

YES

NO

Or other entity:

Attach all of the

__ __ - __ __ __ __ __ __ __

(Fill out this row)

business names.

________________________

Part 2 - Exemption:

If exempt from Form 1099 reporting, check here

AND circle our qualifying exemption reason below:

(Individuals do not complete Part 2)

1. Corporation

. Tax Exempt

3. The United States

4. A state, the District of

5. A foreign government

2

or any of its agencies

Columbia, a possession of

or any of its political

except there is no

Charity under

exemption for medical

501(a) includes

or instrumentalities

the United States, or any of

subdivisions

and healthcare

501 (c) (3), or IRA

their political subdivisions

payments or payments

for legal services

Part 3 – Signature

:

I am a U. S. person (including a U.S. resident alien)

Person completing this form: ______________________________________________

Title: _________________________________________________________________

If address for payments is different, please list

Signature: ___________________________________ Date: _____________________

payment remit address below.

Tax correspondence address: ______________________________________________

_____________________________________

______________________________________

______________________________

City: ______________________________State: __________ ZIP: ________________

_____________________________________

Phone: (_______) ________________________________________________________

Revised 2/25/05

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1