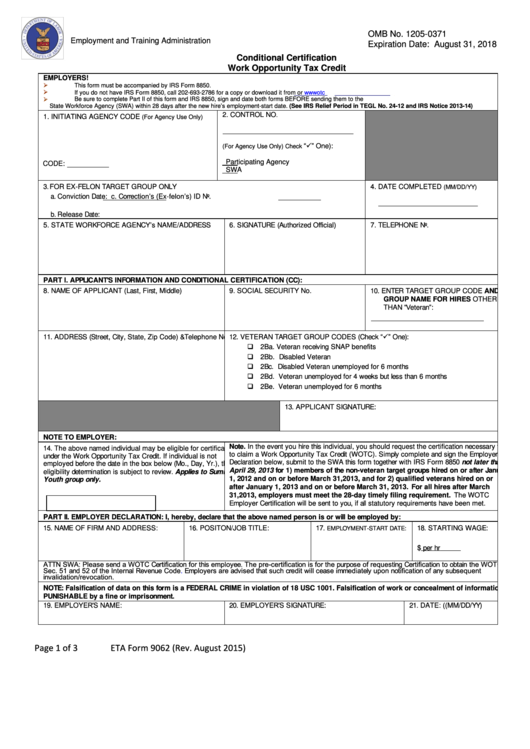

Eta Form 9062 (Rev. August 2015) - Conditional Certification Work Opportunity Tax Credit

ADVERTISEMENT

U.S. Department Labor

OMB No. 1205-0371

Employment and Training Administration

Expiration Date: August 31, 2018

Conditional Certification

Work Opportunity Tax Credit

EMPLOYERS!

This form must be accompanied by IRS Form 8850.

If you do not have IRS Form 8850, call 202-693-2786 for a copy or download it from

or

Be sure to complete Part II of this form and IRS 8850, sign and date both forms BEFORE sending them to the

State W orkforce Agency (SWA) within 28 days after the new hire’s employment-start date. (See IRS Relief Period in TEGL No. 24-12 and IRS Notice 2013-14)

2. CONTROL NO

.

1. INITIATING AGENCY CODE

(For Agency Use Only)

“” One):

(For Agency Use Only) Check

Participating Agency

CODE:

SWA

3. FOR EX-FELON TARGET GROUP ONLY

4. DATE COMPLETED

(MM/DD/YY)

a. Conviction Date:

c. Correction’s (Ex-felon’s) ID No.

b. Release Date:

5. STATE WORKFORCE AGENCY’s NAME/ADDRESS

6. SIGNATURE (Authorized Official)

7. TELEPHONE No.

PART I. APPLICANT’S INFORMATION AND CONDITIONAL CERTIFICATION (CC):

8. NAME OF APPLICANT (Last, First, Middle)

9. SOCIAL SECURITY No.

10. ENTER TARGET GROUP CODE AND

GROUP NAME FOR HIRES OTHER

THAN “Veteran”:

12. VETERAN TARGET GROUP CODES (Check “” One):

11. ADDRESS (Street, City, State, Zip Code) &Telephone No.

2Ba. Veteran receiving SNAP benefits

2Bb. Disabled Veteran

2Bc. Disabled Veteran unemployed for 6 months

2Bd. Veteran unemployed for 4 weeks but less than 6 months

2Be. Veteran unemployed for 6 months

13. APPLICANT SIGNATURE:

NOTE TO EMPLOYER:

Note. In the event you hire this individual, you should request the certification necessary for you

14. The above named individual may be eligible for certification

to claim a Work Opportunity Tax Credit (WOTC). Simply complete and sign the Employer

under the Work Opportunity Tax Credit. If individual is not

Declaration below, submit to the SWA this form together with IRS Form 8850 not later than

employed before the date in the box below (Mo., Day, Yr.), this

April 29, 2013 for 1) members of the non-veteran target groups hired on or after January

eligibility determination is subject to review. Applies to Summer

1, 2012 and on or before March 31, 2013, and for 2) qualified veterans hired on or

Youth group only.

after January 1, 2013 and on or before March 31, 2013. For all hires after March

31, 2013, employers must meet the 28-day timely filing requirement. The WOTC

Employer Certification will be sent to you, if all statutory requirements have been met.

PART II. EMPLOYER DECLARATION: I, hereby, declare that the above named person is or will be employed by:

15. NAME OF FIRM AND ADDRESS:

16. POSITON/JOB TITLE:

17.

18. STARTING WAGE:

EMPLOYMENT-START DATE:

$

per hr

ATTN SWA: Please send a WOTC Certification for this employee. The pre-certification is for the purpose of requesting Certification to obtain the WOTC under

Sec. 51 and 52 of the Internal Revenue

Code.

Employers are advised that such credit will cease immediately upon notification of any subsequent

invalidation/revocation.

NOTE: Falsification of data on this form is a FEDERAL CRIME in violation of 18 USC 1001. Falsification of work or concealment of information is

PUNISHABLE by a fine or imprisonment.

19. EMPLOYER’S NAME:

20. EMPLOYER’S SIGNATURE:

21. DATE: ((MM/DD/YY)

Page 1 of 3

ETA Form 9062 (Rev. August 2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3