Roth Conversion/recharacterization Request

ADVERTISEMENT

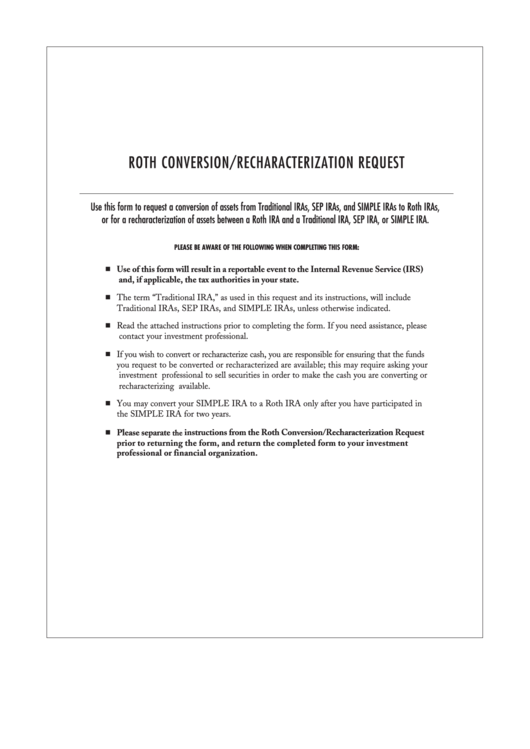

ROTH CONVERSION/RECHARACTERIZATION REQUEST

Use this form to request a conversion of assets from Traditional IRAs, SEP IRAs, and SIMPLE IRAs to Roth IRAs,

or for a recharacterization of assets between a Roth IRA and a Traditional IRA, SEP IRA, or SIMPLE IRA.

PLEASE BE AWARE OF THE FOLLOWING WHEN COMPLETING THIS FORM:

I

Use of this form will result in a reportable event to the Internal Revenue Service (IRS)

and, if applicable, the tax authorities in your state.

I

The term “Traditional IRA,” as used in this request and its instructions, will include

Traditional IRAs, SEP IRAs, and SIMPLE IRAs, unless otherwise indicated.

I

Read the attached instructions prior to completing the form. If you need assistance, please

contact your investment professional.

I

If you wish to convert or recharacterize cash, you are responsible for ensuring that the funds

you request to be converted or recharacterized are available; this may require asking your

investment professional to sell securities in order to make the cash you are converting or

recharacterizing available.

I

You may convert your SIMPLE IRA to a Roth IRA only after you have participated in

the SIMPLE IRA for two years.

I

Please separate

instructions from the Roth Conversion/Recharacterization Request

the

prior to returning the form, and return the completed form to your investment

professional or financial organization.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3