Contract Exchange And Plan Transfer Withdrawal Request

ADVERTISEMENT

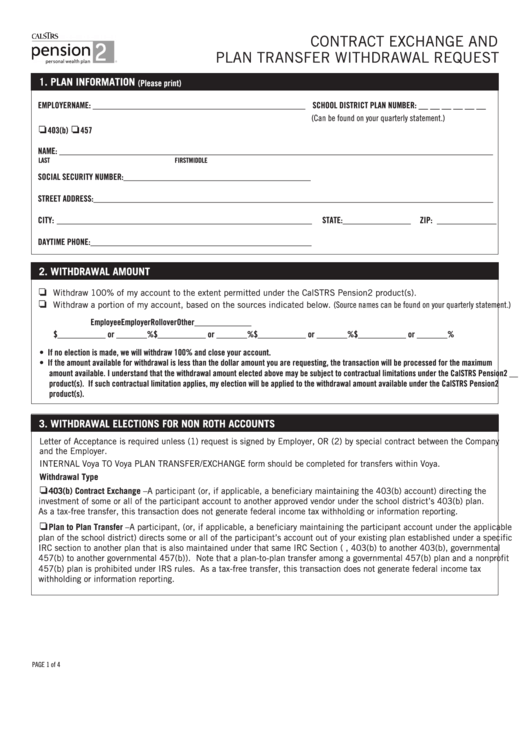

CONTRACT EXCHANGE AND

PLAN TRANSFER WITHDRAWAL REQUEST

1. PLAN INFORMATION

(Please print)

__ __ __ __ __ __

EMPLOYER NAME: __________________________________________________ SCHOOL DISTRICT PLAN NUMBER:

(Can be found on your quarterly statement.)

❏

❏

403(b)

457

NAME: ______________________________________________________________________________________________________

LAST

FIRST

MIDDLE

SOCIAL SECURITY NUMBER: ____________________________________________

STREET ADDRESS: ______________________________________________________________________________________________

CITY: ____________________________________________________________

STATE:________________

ZIP: ______________

DAYTIME PHONE: ____________________________________________________

2. WITHDRAWAL AMOUNT

❏

Withdraw 100% of my account to the extent permitted under the CalSTRS Pension2 product(s).

❏

Withdraw a portion of my account, based on the sources indicated below. (Source names can be found on your quarterly statement.)

Employee

Employer

Rollover

Other_____________

$___________ or _______%

$___________ or _______%

$___________ or _______%

$___________ or _______%

• If no election is made, we will withdraw 100% and close your account.

• If the amount available for withdrawal is less than the dollar amount you are requesting, the transaction will be processed for the maximum

amount available. I understand that the withdrawal amount elected above may be subject to contractual limitations under the CalSTRS Pension2 __

product(s). If such contractual limitation applies, my election will be applied to the withdrawal amount available under the CalSTRS Pension2

product(s).

3. WITHDRAWAL ELECTIONS FOR NON ROTH ACCOUNTS

W3TWITHDRAWAL ELECTIONS FOR NON ROTH ACCOUNTSNTS

Letter of Acceptance is required unless (1) request is signed by Employer, OR (2) by special contract between the Company

and the Employer.

INTERNAL Voya TO Voya PLAN TRANSFER/EXCHANGE form should be completed for transfers within Voya.

Withdrawal Type

❏

403(b) Contract Exchange – A participant (or, if applicable, a beneficiary maintaining the 403(b) account) directing the

investment of some or all of the participant account to another approved vendor under the school district’s 403(b) plan.

As a tax-free transfer, this transaction does not generate federal income tax withholding or information reporting.

❏

Plan to Plan Transfer – A participant, (or, if applicable, a beneficiary maintaining the participant account under the applicable

plan of the school district) directs some or all of the participant’s account out of your existing plan established under a specific

IRC section to another plan that is also maintained under that same IRC Section (e.g., 403(b) to another 403(b), governmental

457(b) to another governmental 457(b)). Note that a plan-to-plan transfer among a governmental 457(b) plan and a nonprofit

457(b) plan is prohibited under IRS rules. As a tax-free transfer, this transaction does not generate federal income tax

withholding or information reporting.

PAGE 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4