Fremont 457 Enrollment Form

ADVERTISEMENT

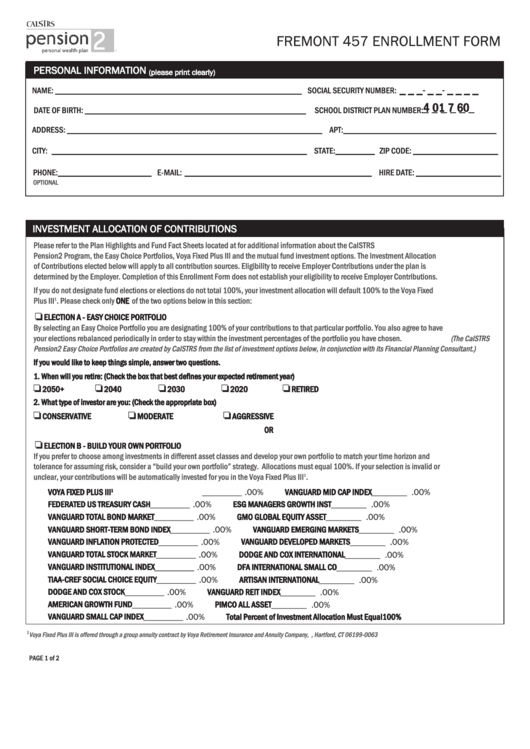

FREMONT 457 ENROLLMENT FORM

PERSONAL INFORMATION

(please print clearly)

_ _ _

_ _

_ _ _ _

-

-

NAME: __________________________________________________________ SOCIAL SECURITY NUMBER:

4 0 1 7 6 0

DATE OF BIRTH: ____________________________________________________ SCHOOL DISTRICT PLAN NUMBER:

ADDRESS:

____________________________________________________________ APT:____________________________________

CITY: ____________________________________________________________ STATE:_________ ZIP CODE: ____________________

PHONE:______________________ E-MAIL: ____________________________________________ HIRE DATE: ____________________

OPTIONAL

INVESTMENT ALLOCATION OF CONTRIBUTIONS

Please refer to the Plan Highlights and Fund Fact Sheets located at

for additional information about the CalSTRS

Pension2 Program, the Easy Choice Portfolios, Voya Fixed Plus III and the mutual fund investment options. The Investment Allocation

of Contributions elected below will apply to all contribution sources. Eligibility to receive Employer Contributions under the plan is

determined by the Employer. Completion of this Enrollment Form does not establish your eligibility to receive Employer Contributions.

If you do not designate fund elections or elections do not total 100%, your investment allocation will default 100% to the Voya Fixed

Plus III

. Please check only

ONE

of the two options below in this section:

1

ELECTION A - EASY CHOICE PORTFOLIO

❏

By selecting an Easy Choice Portfolio you are designating 100% of your contributions to that particular portfolio. You also agree to have

your elections rebalanced periodically in order to stay within the investment percentages of the portfolio you have chosen. (The CalSTRS

Pension2 Easy Choice Portfolios are created by CalSTRS from the list of investment options below, in conjunction with its Financial Planning Consultant.)

If you would like to keep things simple, answer two questions.

1. When will you retire: (Check the box that best defines your expected retirement year)

2050+

2040

2030

2020

RETIRED

❏

❏

❏

❏

❏

2. What type of investor are you: (Check the appropriate box)

CONSERVATIVE

MODERATE

AGGRESSIVE

❏

❏

❏

OR

ELECTION B - BUILD YOUR OWN PORTFOLIO

❏

If you prefer to choose among investments in different asset classes and develop your own portfolio to match your time horizon and

tolerance for assuming risk, consider a “build your own portfolio” strategy. Allocations must equal 100%. If your selection is invalid or

unclear, your contributions will be automatically invested for you in the Voya Fixed Plus III

.

1

VOYA FIXED PLUS III

VANGUARD MID CAP INDEX

_________ .00%

________ .00%

1

FEDERATED US TREASURY CASH

ESG MANAGERS GROWTH INST

_________ .00%

________ .00%

VANGUARD TOTAL BOND MARKET

GMO GLOBAL EQUITY ASSET

_________ .00%

________ .00%

VANGUARD SHORT-TERM BOND INDEX

VANGUARD EMERGING MARKETS

_________ .00%

________ .00%

VANGUARD INFLATION PROTECTED

VANGUARD DEVELOPED MARKETS

_________ .00%

________ .00%

VANGUARD TOTAL STOCK MARKET

DODGE AND COX INTERNATIONAL

_________ .00%

________ .00%

VANGUARD INSTITUTIONAL INDEX

DFA INTERNATIONAL SMALL CO

_________ .00%

________ .00%

TIAA-CREF SOCIAL CHOICE EQUITY

ARTISAN INTERNATIONAL

_________ .00%

________ .00%

DODGE AND COX STOCK

VANGUARD REIT INDEX

_________ .00%

________ .00%

AMERICAN GROWTH FUND

PIMCO ALL ASSET

_________ .00%

________ .00%

VANGUARD SMALL CAP INDEX

Total Percent of Investment Allocation Must Equal

100%

_________ .00%

Voya Fixed Plus III is offered through a group annuity contract by Voya Retirement Insurance and Annuity Company, P.O. Box 990063, Hartford, CT 06199-0063

1

PAGE 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2