Medical Expense - Dallas County

Download a blank fillable Medical Expense - Dallas County in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Medical Expense - Dallas County with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

~

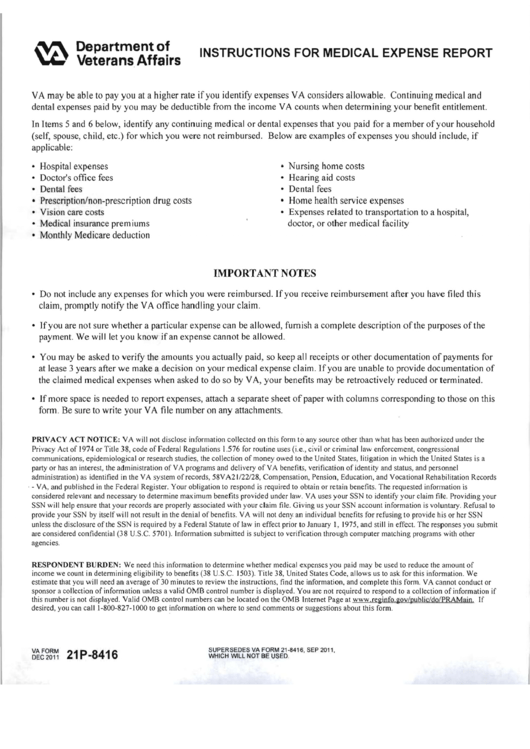

Department of

INSTRUCTIONS FOR MEDICAL EXPENSE REPORT

~

Veterans Affairs

VA may be able to pay you at a higher rate if you identify expenses VA considers allowable. Continuing medical and

dental expenses paid by you may be deductible from the income VA counts when determining your benefit entitlement.

In Items 5 and 6 below, identify any continuing medical or dental expenses that you paid for a member of your household

(self, spouse, child, etc.) for which you were not reimbursed. Below are examples of expenses you should include, if

applicable:

• Hospital expenses

• Nursing home costs

• Doctor's office fees

• Hearing aid costs

• Dental fees

• Dental fees

• Prescription/non-prescription drug costs

• Home health service expenses

• Vision care costs

• Expenses related to transportation to a hospital,

• Medical insurance prem iums

doctor, or other medical facility

• Monthly Medicare deduction

IMPORTANT

NOTES

• Do not include any expenses for which you were reimbursed. If you receive reimbursement after you have fi led this

claim, promptly notify the VA office handling your claim.

• If you are not sure whether a particular expense can be allowed, furnish a complete description of the purposes of the

payment. We will let you know if an expense cannot be allowed.

• You may be asked to verify the amounts you actually paid, so keep all receipts or other documentation of payments for

at lease 3 years after we make a decision on your medical expense claim. If you are unable to provide documentation of

the claimed medical expenses when asked to do so by VA, your benefits may be retroactively reduced or terminated.

• If more space is needed to report expenses, attach a separate sheet of paper with columns corresponding to those on this

form. Be sure to write your VA file number on any attachments.

PRIVACY ACT NOTICE: VA will not disclose information coHected on this form to any source other than what has been authorized under the

Privacy Act of 1974 or Title 38, code of Federal Regulations 1.576 for routine uses (i.e., civil or criminal law enforcement, congressional

communications, epidemiological or research studies, the collection of money owed to the United States, litigation in which the United States is a

party or has an interest, the administration of VA programs and delivery of VA benefits, verification of identity and status, and personnel

administration) as identified in the VA system of records, 58VA21 /22/28, Compensation, Pension, Education, and Vocational Rehabilitation Records

. - VA, and published in the Federal Register. Your obligation to respond is required to obtain or retain benefits. The requested information is

considered relevant and necessary to determine maximum benefits provided under law. VA uses your SSN to identify your claim file. Providing your

SSN will help ensure that your records are properly associated with your claim file. Giving us your SSN account information is voluntary. Refusal to

provide your SSN by itself will not result in the denial of benefits. VA will not deny an individual benefits for refusing to provide his or her SSN

unless the disclosure of the SSN is required by a Federal Statute of law in effect prior to January I, 1975, and still in effect. The responses you submit

are considered confidential (38 U.S.c. 570 I). Information submitted is subject to verification through computer matching programs with other

agencies.

RESPONDENT BURDEN: We need this information to determine whether medical expenses you paid may be used to reduce the amount of

income we count in detennining eligibility to benefits (38 usc. 1503). Title 38, United States Code, allows us to ask for this infonnation. We

estimate that you will need an average of 30 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or

sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if

this number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at If

desired, you can call 1-800-827-1000 to get information on where to send comments or suggestions about this form.

VA FORM

SUPERSEDES VA FORM 21-8416, SEP 2011,

DEC 2011

WHICH WILL NOT BE USED

21 P-8416

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3