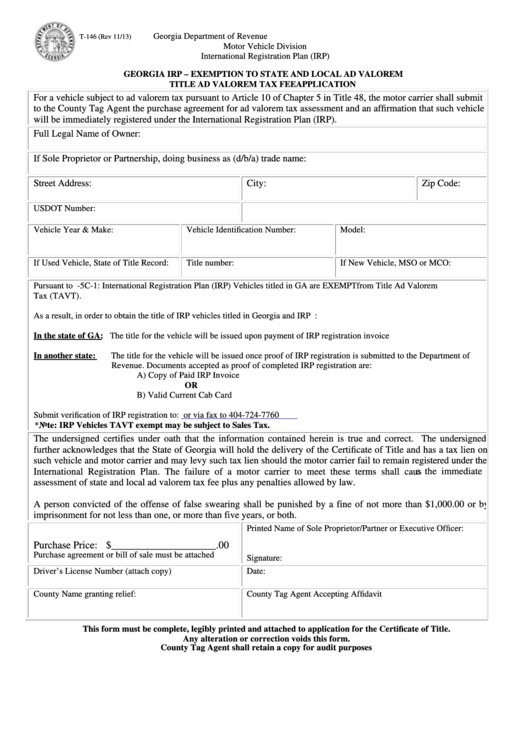

PRINT

CLEAR

Georgia Department of Revenue

T-146 (Rev 11/13)

Motor Vehicle Division

International Registration Plan (IRP)

GEORGIA IRP – EXEMPTION TO STATE AND LOCAL AD VALOREM

TITLE AD VALOREM TAX FEE APPLICATION

For a vehicle subject to ad valorem tax pursuant to Article 10 of Chapter 5 in Title 48, the motor carrier shall submit

to the County Tag Agent the purchase agreement for ad valorem tax assessment and an affirmation that such vehicle

will be immediately registered under the International Registration Plan (IRP).

Full Legal Name of Owner:

If Sole Proprietor or Partnership, doing business as (d/b/a) trade name:

Street Address:

City:

Zip Code:

USDOT Number:

Vehicle Year & Make:

Vehicle Identification Number:

Model:

If Used Vehicle, State of Title Record:

Title number:

If New Vehicle, MSO or MCO:

Pursuant to O.C.G.A 48-5C-1: International Registration Plan (IRP) Vehicles titled in GA are EXEMPT from Title Ad Valorem

Tax (TAVT).

As a result, in order to obtain the title of IRP vehicles titled in Georgia and IRP registered...:

In the state of GA: The title for the vehicle will be issued upon payment of IRP registration invoice

In another state:

The title for the vehicle will be issued once proof of IRP registration is submitted to the Department of

Revenue. Documents accepted as proof of completed IRP registration are:

A) Copy of Paid IRP Invoice

OR

B) Valid Current Cab Card

Submit verification of IRP registration to:

commercial.vehicles@dor.ga.gov

or via fax to 404-724-7760

*Note: IRP Vehicles TAVT exempt may be subject to Sales Tax.

The undersigned certifies under oath that the information contained herein is true and correct. The undersigned

further acknowledges that the State of Georgia will hold the delivery of the Certificate of Title and has a tax lien on

such vehicle and motor carrier and may levy such tax lien should the motor carrier fail to remain registered under the

International Registration Plan. The failure of a motor carrier to meet these terms shall cause the immediate

assessment of state and local ad valorem tax fee plus any penalties allowed by law.

A person convicted of the offense of false swearing shall be punished by a fine of not more than $1,000.00 or by

imprisonment for not less than one, or more than five years, or both.

Printed Name of Sole Proprietor/Partner or Executive Officer:

Purchase Price: $____________________.00

Purchase agreement or bill of sale must be attached

Signature:

Driver’s License Number (attach copy)

Date:

County Name granting relief:

County Tag Agent Accepting Affidavit

This form must be complete, legibly printed and attached to application for the Certificate of Title.

Any alteration or correction voids this form.

County Tag Agent shall retain a copy for audit purposes

1

1