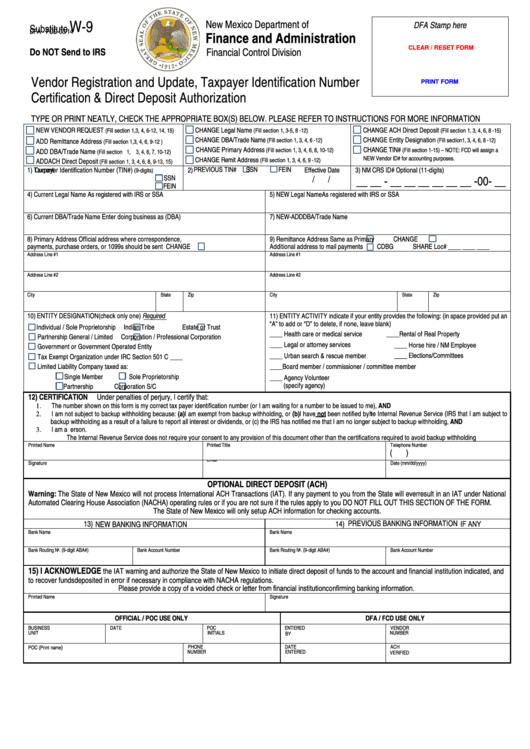

W-9

New Mexico Department of

DFA Stamp here

Substitute

Finance and Administration

D F A - FCD 0 3/14

D o N O T S e nd to I RS

Financial Control Division

CLEAR / RESET FORM

Vendor Registration and Update, Taxpayer Identification Number

PRINT FORM

Certification & Direct Deposit Authorization

TYPE OR PRINT NEATLY, CHECK THE APPROPRIATE BOX(S) BELOW. PLEASE REFER TO INSTRUCTIONS FOR MORE INFORMATION

NEW VENDOR REQUEST

CHANGE Legal Name

CHANGE ACH Direct Deposit

(Fill section 1,3, 4, 6-12, 14, 15)

(Fill section 1, 3-5, 8 -12)

(Fill section 1, 3, 4, 6, 8 -15)

CHANGE DBA/Trade Name

CHANGE Entity Designation

(Fill section 1, 3, 4, 6 -12)

(Fill section 1, 3, 4, 6, 8 -12)

ADD Remittance Address

(Fill section 1,3, 4, 6, 9-12 )

CHANGE Primary Address

CHANGE TIN#

(Fill section 1, 3, 4, 6, 8, 10-12)

(Fill section 1-15) – NOTE: FCD will assign a

ADD DBA/Trade Name

(Fill section 1, 3, 4, 6, 7, 10-12 )

CHANGE Remit Address

NEW Vendor ID# for accounting purposes.

(Fill section 1, 3, 4, 6, 9 -12)

ADD ACH Direct Deposit

(Fill section 1, 3, 4, 6, 8, 9-13, 15)

2) PREVIOUS TIN#

SSN

FEIN

1)

Current

Taxpayer Identification Number (TIN#)

Effective Date

3) NM CRS ID# Optional (11-digits)

(9-digits)

__ __ - __ __ __ __ __ __ -00- __

/

/

SSN

FEIN

4) Current Legal Name As registered with IRS or SSA

5) NEW Legal Name As registered with IRS or SSA

6) Current DBA/Trade Name Enter doing business as (DBA)

7) NEW-ADD DBA/Trade Name

8) Primary Address Official address where correspondence,

9) Remittance Address

Same as Primary

CHANGE

payments, purchase orders, or 1099s should be sent

CHANGE

Additional address to mail payments

CDBG

SHARE Loc# ____ ____ ____

Address Line #1

Address Line #1

Address Line #2

Address Line #2

City

State

Zip

City

State

Zip

10) ENTITY DESIGNATION (check only one) Required

11) ENTITY ACTIVITY indicate if your entity provides the following: (in space provided put an

“A” to add or “D” to delete, if none, leave blank)

Individual / Sole Proprietorship

Indian Tribe

Estate or Trust

____ Health care or medical service

____ Rental of Real Property

Partnership General / Limited

Corporation / Professional Corporation

____ Legal or attorney services

____ Horse hire / NM Employee

Government or Government Operated Entity

____ Urban search & rescue member

____ Elections/Committees

Tax Exempt Organization under IRC Section 501 C ____

Limited Liability Company taxed as:

____Board member / commissioner / committee member

Single Member

Sole Proprietorship

____ Agency Volunteer

(specify agency)

Partnership

Corporation S/C

12) CERTIFICATION

Under penalties of perjury, I certify that:

The number shown on this form is my correct tax payer identification number (or I am waiting for a number to be issued to me), AND

1.

I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS that I am subject to

2.

backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, AND

I am a U.S. Citizen or other U.S. person.

3.

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding

Printed Name

Printed Title

Telephone Number

(

)

Signature

Email

Date (mm/dd/yyyy)

OPTIONAL DIRECT DEPOSIT (ACH)

Warning: The State of New Mexico will not process International ACH Transactions (IAT). If any payment to you from the State will ever result in an IAT under National

Automated Clearing House Association (NACHA) operating rules or if you are not sure if the rules apply to you DO NOT FILL OUT THIS SECTION OF THE FORM.

The State of New Mexico will only setup ACH information for checking accounts.

PREVIOUS BANKING INFORMATION

IF ANY

13)

NEW BANKING INFORMATION

14)

Bank Name

Bank Name

Bank Routing No. (9-digit ABA#)

Bank Account Number

Bank Routing No. (9-digit ABA#)

Bank Account Number

15) I ACKNOWLEDGE

the IAT warning and authorize the State of New Mexico to initiate direct deposit of funds to the account and financial institution indicated, and

to recover funds deposited in error if necessary in compliance with NACHA regulations.

Please provide a copy of a voided check or letter from financial institution confirming banking information.

Printed Name

Signature

OFFICIAL / POC USE ONLY

DFA / FCD USE ONLY

BUSINESS

DATE

POC

ENTERED

VENDOR

UNIT

INITIALS

BY

NUMBER

)

PHONE

DATE

ACH

POC (Print name

NUMBER

ENTERED

VERIFIED

1

1 2

2