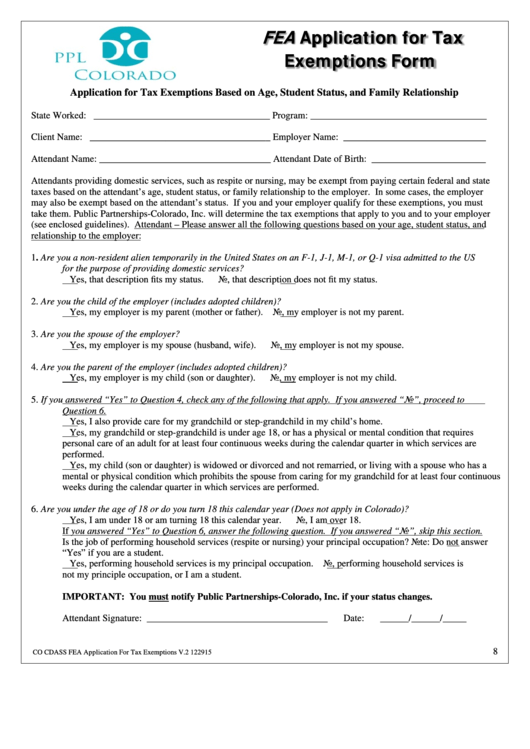

Fea Application For Tax Exemptions Form

ADVERTISEMENT

FEA

Application for Tax

Exemptions Form

Application for Tax Exemptions Based on Age, Student Status, and Family Relationship

State Worked: _____________________________________

Program: _____________________________________

Client Name: ______________________________________

Employer Name: ______________________________

Attendant Name: ____________________________________

Attendant Date of Birth: ________________________

Attendants providing domestic services, such as respite or nursing, may be exempt from paying certain federal and state

taxes based on the attendant’s age, student status, or family relationship to the employer. In some cases, the employer

may also be exempt based on the attendant’s status. If you and your employer qualify for these exemptions, you must

take them. Public Partnerships-Colorado, Inc. will determine the tax exemptions that apply to you and to your employer

(see enclosed guidelines). Attendant – Please answer all the following questions based on your age, student status, and

relationship to the employer:

1.

Are you a non-resident alien temporarily in the United States on an F-1, J-1, M-1, or Q-1 visa admitted to the US

for the purpose of providing domestic services?

Yes, that description fits my status.

No, that description does not fit my status.

2.

Are you the child of the employer (includes adopted children)?

Yes, my employer is my parent (mother or father).

No, my employer is not my parent.

3.

Are you the spouse of the employer?

Yes, my employer is my spouse (husband, wife).

No, my employer is not my spouse.

4.

Are you the parent of the employer (includes adopted children)?

Yes, my employer is my child (son or daughter).

No, my employer is not my child.

5.

If you answered “Yes” to Question 4, check any of the following that apply. If you answered “No”, proceed to

Question 6.

Yes, I also provide care for my grandchild or step-grandchild in my child’s home.

Yes, my grandchild or step-grandchild is under age 18, or has a physical or mental condition that requires

personal care of an adult for at least four continuous weeks during the calendar quarter in which services are

performed.

Yes, my child (son or daughter) is widowed or divorced and not remarried, or living with a spouse who has a

mental or physical condition which prohibits the spouse from caring for my grandchild for at least four continuous

weeks during the calendar quarter in which services are performed.

6.

Are you under the age of 18 or do you turn 18 this calendar year (Does not apply in Colorado)?

Yes, I am under 18 or am turning 18 this calendar year.

No, I am over 18.

If you answered “Yes” to Question 6, answer the following question. If you answered “No”, skip this section.

Is the job of performing household services (respite or nursing) your principal occupation? Note: Do not answer

“Yes” if you are a student.

Yes, performing household services is my principal occupation.

No, performing household services is

not my principle occupation, or I am a student.

IMPORTANT: You must notify Public Partnerships-Colorado, Inc. if your status changes.

Attendant Signature: ______________________________________

Date: ______/______/_____

8

CO CDASS FEA Application For Tax Exemptions V.2 122915

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3