Exemption Application Form - Colorado Springs

ADVERTISEMENT

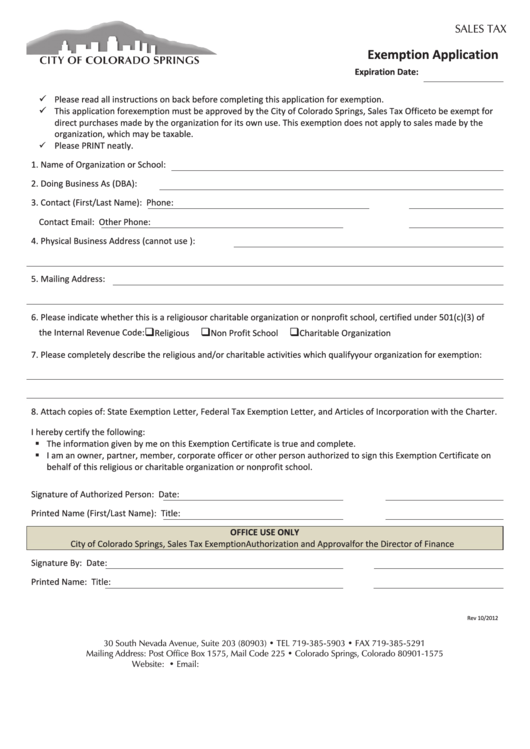

SALES TAX

Exemption Application

Expiration Date:

Please read all instructions on back before completing this application for exemption.

This application for exemption must be approved by the City of Colorado Springs, Sales Tax Office to be exempt for

direct purchases made by the organization for its own use. This exemption does not apply to sales made by the

organization, which may be taxable.

Please PRINT neatly.

1. Name of Organization or School:

2. Doing Business As (DBA):

3. Contact (First/Last Name):

Phone:

Contact Email:

Other Phone:

4. Physical Business Address (cannot use P.O. Box):

5. Mailing Address:

6. Please indicate whether this is a religious or charitable organization or nonprofit school, certified under 501(c)(3) of

the Internal Revenue Code:

Religious

Non Profit School

Charitable Organization

7. Please completely describe the religious and/or charitable activities which qualify your organization for exemption:

8. Attach copies of: State Exemption Letter, Federal Tax Exemption Letter, and Articles of Incorporation with the Charter.

I hereby certify the following:

The information given by me on this Exemption Certificate is true and complete.

I am an owner, partner, member, corporate officer or other person authorized to sign this Exemption Certificate on

behalf of this religious or charitable organization or nonprofit school.

Signature of Authorized Person:

Date:

Printed Name (First/Last Name):

Title:

OFFICE USE ONLY

City of Colorado Springs, Sales Tax Exemption Authorization and Approval for the Director of Finance

Signature By:

Date:

Printed Name:

Title:

Rev 10/2012

30 South Nevada Avenue, Suite 203 (80903) • TEL 719-385-5903 • FAX 719-385-5291

Mailing Address: Post Office Box 1575, Mail Code 225 • Colorado Springs, Colorado 80901-1575

Website: • Email:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2