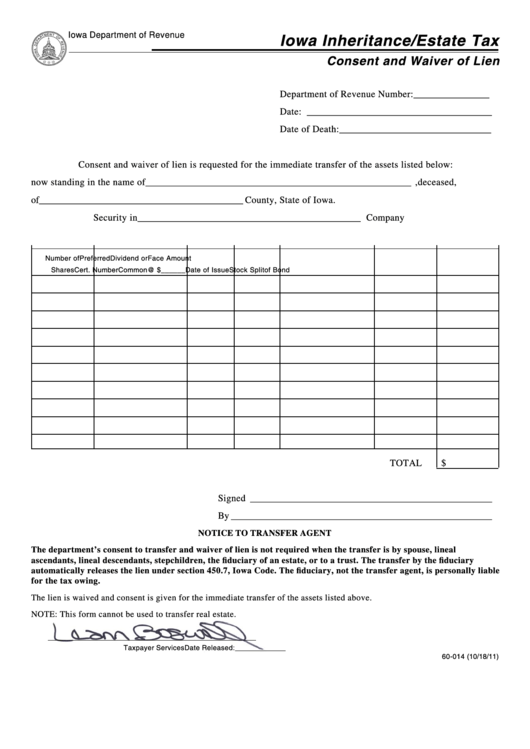

Form 60-014 - Iowa Inheritance Estate Tax Consent And Waiver Of Lien

ADVERTISEMENT

Iowa Department of Revenue

Iowa Inheritance/Estate Tax

Consent and Waiver of Lien

Department of Revenue Number: ________________

Date: _______________________________________

Date of Death: ________________________________

Consent and waiver of lien is requested for the immediate transfer of the assets listed below:

now standing in the name of ________________________________________________________ ,deceased,

of ___________________________________________ County, State of Iowa.

Security in _______________________________________________ Company

Number of

Preferred

Dividend or

Face Amount

Shares

Cert. Number

Common

@ $______

Date of Issue

Stock Split

of Bond

TOTAL

$

Signed ___________________________________________________

By _______________________________________________________

NOTICE TO TRANSFER AGENT

The department’s consent to transfer and waiver of lien is not required when the transfer is by spouse, lineal

ascendants, lineal descendants, stepchildren, the fiduciary of an estate, or to a trust. The transfer by the fiduciary

automatically releases the lien under section 450.7, Iowa Code. The fiduciary, not the transfer agent, is personally liable

for the tax owing.

The lien is waived and consent is given for the immediate transfer of the assets listed above.

NOTE: This form cannot be used to transfer real estate.

Taxpayer Services

Date Released: _____________

60-014 (10/18/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1