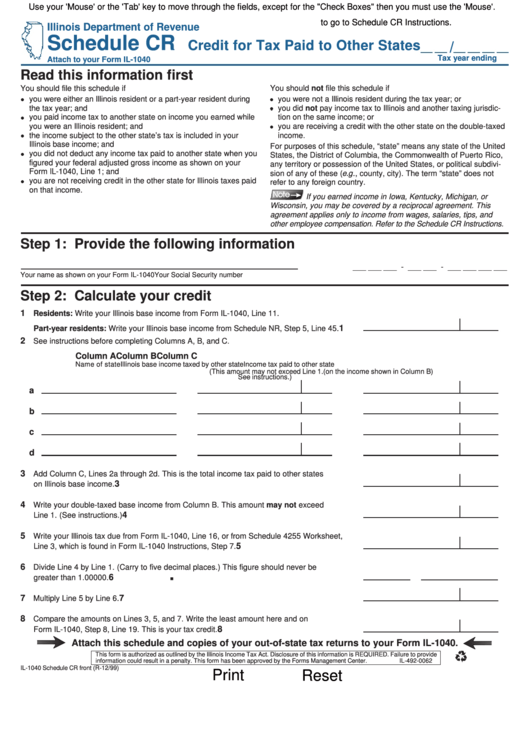

Use your 'Mouse' or the 'Tab' key to move through the fields, except for the "Check Boxes" then you must use the 'Mouse'.

Click here to go to Schedule CR Instructions.

Illinois Department of Revenue

Schedule CR

Credit for Tax Paid to Other States

/

Tax year ending

Attach to your Form IL-1040

Read this information first

You should file this schedule if

You should not file this schedule if

you were either an Illinois resident or a part-year resident during

you were not a Illinois resident during the tax year; or

the tax year; and

you did not pay income tax to Illinois and another taxing jurisdic-

you paid income tax to another state on income you earned while

tion on the same income; or

you were an Illinois resident; and

you are receiving a credit with the other state on the double-taxed

the income subject to the other state’s tax is included in your

income.

Illinois base income; and

For purposes of this schedule, “state” means any state of the United

you did not deduct any income tax paid to another state when you

States, the District of Columbia, the Commonwealth of Puerto Rico,

figured your federal adjusted gross income as shown on your

any territory or possession of the United States, or political subdivi-

Form IL-1040, Line 1; and

sion of any of these ( e.g ., county, city). The term “state” does not

you are not receiving credit in the other state for Illinois taxes paid

refer to any foreign country.

on that income.

If you earned income in Iowa, Kentucky, Michigan, or

Wisconsin, you may be covered by a reciprocal agreement. This

agreement applies only to income from wages, salaries, tips, and

other employee compensation. Refer to the Schedule CR Instructions.

Step 1: Provide the following information

___ ___ ___ - ___ ___ - ___ ___ ___ ___

Your name as shown on your Form IL-1040

Your Social Security number

Step 2: Calculate your credit

1

Residents: Write your Illinois base income from Form IL-1040, Line 11.

1

Part-year residents: Write your Illinois base income from Schedule NR, Step 5, Line 45.

2

See instructions before completing Columns A, B, and C.

Column A

Column B

Column C

Name of state

Illinois base income taxed by other state

Income tax paid to other state

(This amount may not exceed Line 1.

(on the income shown in Column B)

See instructions.)

a

b

c

d

3

Add Column C, Lines 2a through 2d. This is the total income tax paid to other states

3

on Illinois base income.

4

Write your double-taxed base income from Column B. This amount may not exceed

4

Line 1. (See instructions.)

5

Write your Illinois tax due from Form IL-1040, Line 16, or from Schedule 4255 Worksheet,

5

Line 3, which is found in Form IL-1040 Instructions, Step 7.

.

6

Divide Line 4 by Line 1. (Carry to five decimal places.) This figure should never be

6

greater than 1.00000.

7

7

Multiply Line 5 by Line 6.

8

Compare the amounts on Lines 3, 5, and 7. Write the least amount here and on

8

Form IL-1040, Step 8, Line 19. This is your tax credit.

Attach this schedule and copies of your out-of-state tax returns to your Form IL-1040.

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-0062

IL-1040 Schedule CR front (R-12/99)

Print

Reset

1

1 2

2