2015 Tax Client Organizer Template

ADVERTISEMENT

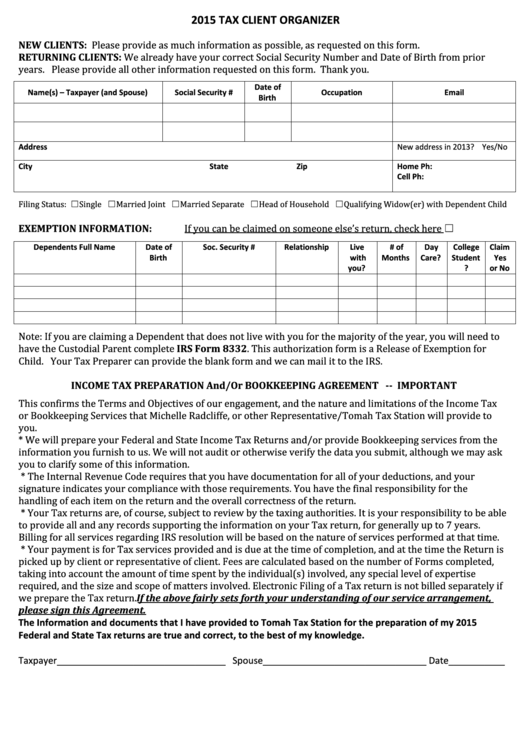

2015 TAX CLIENT ORGANIZER

NEW CLIENTS: Please provide as much information as possible, as requested on this form.

RETURNING CLIENTS: We already have your correct Social Security Number and Date of Birth from prior

years. Please provide all other information requested on this form. Thank you.

Date of

Name(s) – Taxpayer (and Spouse)

Social Security #

Occupation

Email

Birth

Address

New address in 2013? Yes/No

City

State

Zip

Home Ph:

Cell Ph:

Filing Status: ☐Single ☐Married Joint ☐Married Separate ☐Head of Household ☐Qualifying Widow(er) with Dependent Child

EXEMPTION INFORMATION:

If you can be claimed on someone else’s return, check here ☐

Dependents Full Name

Date of

Soc. Security #

Relationship

Live

# of

Day

College

Claim

Birth

with

Months

Care?

Student

Yes

you?

?

or No

Note: If you are claiming a Dependent that does not live with you for the majority of the year, you will need to

have the Custodial Parent complete IRS Form 8332. This authorization form is a Release of Exemption for

Child. Your Tax Preparer can provide the blank form and we can mail it to the IRS.

INCOME TAX PREPARATION And/Or BOOKKEEPING AGREEMENT -- IMPORTANT

This confirms the Terms and Objectives of our engagement, and the nature and limitations of the Income Tax

or Bookkeeping Services that Michelle Radcliffe, or other Representative/Tomah Tax Station will provide to

you.

* We will prepare your Federal and State Income Tax Returns and/or provide Bookkeeping services from the

information you furnish to us. We will not audit or otherwise verify the data you submit, although we may ask

you to clarify some of this information.

* The Internal Revenue Code requires that you have documentation for all of your deductions, and your

signature indicates your compliance with those requirements. You have the final responsibility for the

handling of each item on the return and the overall correctness of the return.

* Your Tax returns are, of course, subject to review by the taxing authorities. It is your responsibility to be able

to provide all and any records supporting the information on your Tax return, for generally up to 7 years.

Billing for all services regarding IRS resolution will be based on the nature of services performed at that time.

* Your payment is for Tax services provided and is due at the time of completion, and at the time the Return is

picked up by client or representative of client. Fees are calculated based on the number of Forms completed,

taking into account the amount of time spent by the individual(s) involved, any special level of expertise

required, and the size and scope of matters involved. Electronic Filing of a Tax return is not billed separately if

we prepare the Tax return.If the above fairly sets forth your understanding of our service arrangement,

please sign this Agreement.

The Information and documents that I have provided to Tomah Tax Station for the preparation of my 2015

Federal and State Tax returns are true and correct, to the best of my knowledge.

Taxpayer_________________________________ Spouse________________________________ Date___________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2