Vita Checklist Volunteer Income Tax Assistance Program

ADVERTISEMENT

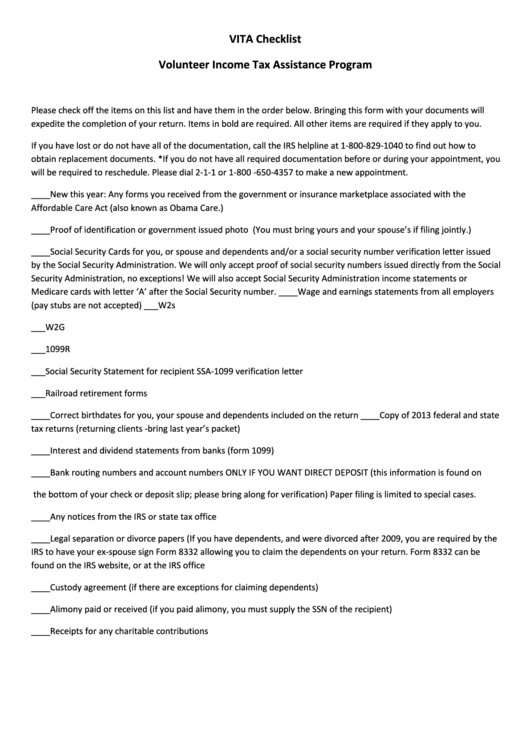

VITA Checklist

Volunteer Income Tax Assistance Program

Please check off the items on this list and have them in the order below. Bringing this form with your documents will

expedite the completion of your return. Items in bold are required. All other items are required if they apply to you.

If you have lost or do not have all of the documentation, call the IRS helpline at 1-800-829-1040 to find out how to

obtain replacement documents. *If you do not have all required documentation before or during your appointment, you

will be required to reschedule. Please dial 2-1-1 or 1-800 -650-4357 to make a new appointment.

____New this year: Any forms you received from the government or insurance marketplace associated with the

Affordable Care Act (also known as Obama Care.)

____Proof of identification or government issued photo I.D. (You must bring yours and your spouse’s if filing jointly.)

____Social Security Cards for you, or spouse and dependents and/or a social security number verification letter issued

by the Social Security Administration. We will only accept proof of social security numbers issued directly from the Social

Security Administration, no exceptions! We will also accept Social Security Administration income statements or

Medicare cards with letter ‘A’ after the Social Security number. ____Wage and earnings statements from all employers

(pay stubs are not accepted) ___W2s

___W2G

___1099R

___Social Security Statement for recipient SSA-1099 verification letter

___Railroad retirement forms

____Correct birthdates for you, your spouse and dependents included on the return ____Copy of 2013 federal and state

tax returns (returning clients -bring last year’s packet)

____Interest and dividend statements from banks (form 1099)

____Bank routing numbers and account numbers ONLY IF YOU WANT DIRECT DEPOSIT (this information is found on

the bottom of your check or deposit slip; please bring along for verification) Paper filing is limited to special cases.

____Any notices from the IRS or state tax office

____Legal separation or divorce papers (If you have dependents, and were divorced after 2009, you are required by the

IRS to have your ex-spouse sign Form 8332 allowing you to claim the dependents on your return. Form 8332 can be

found on the IRS website, or at the IRS office

____Custody agreement (if there are exceptions for claiming dependents)

____Alimony paid or received (if you paid alimony, you must supply the SSN of the recipient)

____Receipts for any charitable contributions

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2