Form Mvd-10963 - New Mexico Weight Distance Tax Return

ADVERTISEMENT

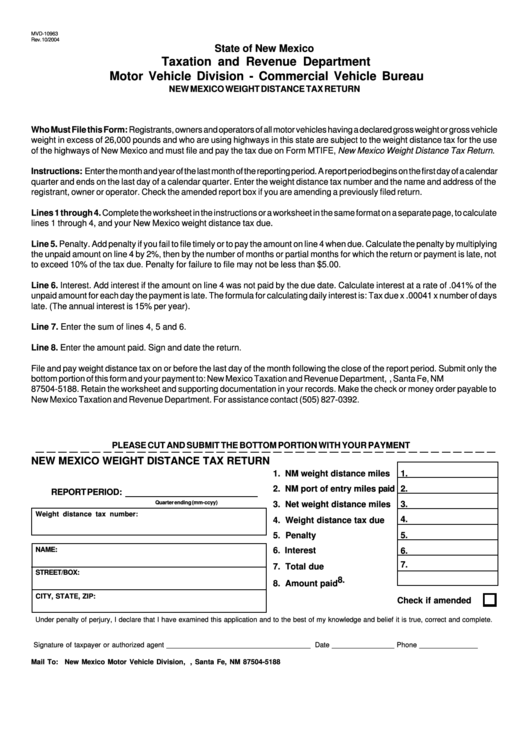

MVD-10963

Rev. 10/2004

State of New Mexico

Taxation and Revenue Department

Motor Vehicle Division - Commercial Vehicle Bureau

NEW MEXICO WEIGHT DISTANCE TAX RETURN

Who Must File this Form: Registrants, owners and operators of all motor vehicles having a declared gross weight or gross vehicle

weight in excess of 26,000 pounds and who are using highways in this state are subject to the weight distance tax for the use

of the highways of New Mexico and must file and pay the tax due on Form MTIFE, New Mexico Weight Distance Tax Return.

Instructions: Enter the month and year of the last month of the reporting period. A report period begins on the first day of a calendar

quarter and ends on the last day of a calendar quarter. Enter the weight distance tax number and the name and address of the

registrant, owner or operator. Check the amended report box if you are amending a previously filed return.

Lines 1 through 4. Complete the worksheet in the instructions or a worksheet in the same format on a separate page, to calculate

lines 1 through 4, and your New Mexico weight distance tax due.

Line 5. Penalty. Add penalty if you fail to file timely or to pay the amount on line 4 when due. Calculate the penalty by multiplying

the unpaid amount on line 4 by 2%, then by the number of months or partial months for which the return or payment is late, not

to exceed 10% of the tax due. Penalty for failure to file may not be less than $5.00.

Line 6. Interest. Add interest if the amount on line 4 was not paid by the due date. Calculate interest at a rate of .041% of the

unpaid amount for each day the payment is late. The formula for calculating daily interest is: Tax due x .00041 x number of days

late. (The annual interest is 15% per year).

Line 7. Enter the sum of lines 4, 5 and 6.

Line 8. Enter the amount paid. Sign and date the return.

File and pay weight distance tax on or before the last day of the month following the close of the report period. Submit only the

bottom portion of this form and your payment to: New Mexico Taxation and Revenue Department, P.O. Box 5188, Santa Fe, NM

87504-5188. Retain the worksheet and supporting documentation in your records. Make the check or money order payable to

New Mexico Taxation and Revenue Department. For assistance contact (505) 827-0392.

PLEASE CUT AND SUBMIT THE BOTTOM PORTION WITH YOUR PAYMENT

NEW MEXICO WEIGHT DISTANCE TAX RETURN

1. NM weight distance miles

1.

2. NM port of entry miles paid

2.

REPORT PERIOD:

Quarter ending (mm-ccyy)

3.

3. Net weight distance miles

Weight distance tax number:

4.

4. Weight distance tax due

5. Penalty

5.

NAME:

6. Interest

6.

7.

7. Total due

STREET/BOX:

8.

8. Amount paid

CITY, STATE, ZIP:

Check if amended

Under penalty of perjury, I declare that I have examined this application and to the best of my knowledge and belief it is true, correct and complete.

Signature of taxpayer or authorized agent _____________________________________ Date ________________ Phone _______________

Mail To:

New Mexico Motor Vehicle Division, P.O. Box 5188, Santa Fe, NM 87504-5188

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2