Power Of Attorney

Download a blank fillable Power Of Attorney in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Power Of Attorney with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

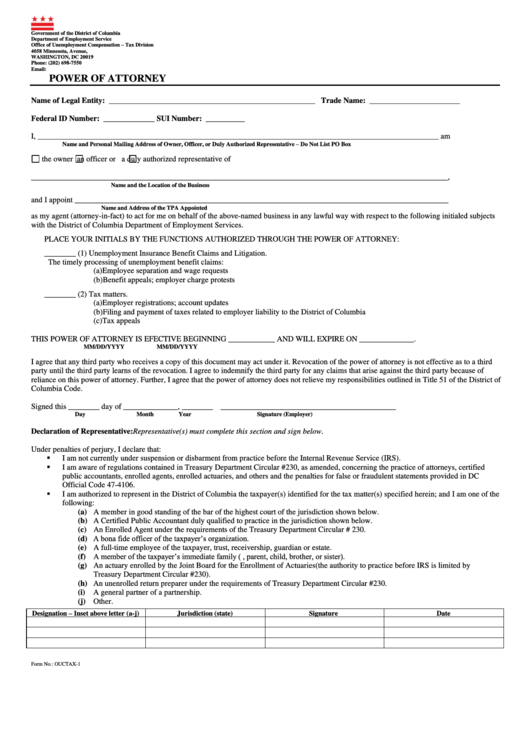

Government of the District of Columbia

Department of Employment Service

Office of Unemployment Compensation – Tax Division

4058 Minnesota, Avenue, N.E.

WASHINGTON, DC 20019

Phone: (202) 698-7550

Email: essp.info@dc.gov

POWER OF ATTORNEY

Name of Legal Entity: _____________________________________________________ Trade Name: _______________________

Federal ID Number: _____________ SUI Number: __________

I, _______________________________________________________________________________________________________ am

Name and Personal Mailing Address of Owner, Officer, or Duly Authorized Representative – Do Not List PO Box

the owner

an officer or

a duly authorized representative of

___________________________________________________________________________________________________________,

Name and the Location of the Business

and I appoint ________________________________________________________________________________________________

Name and Address of the TPA Appointed

as my agent (attorney-in-fact) to act for me on behalf of the above-named business in any lawful way with respect to the following initialed subjects

with the District of Columbia Department of Employment Services.

PLACE YOUR INITIALS BY THE FUNCTIONS AUTHORIZED THROUGH THE POWER OF ATTORNEY:

________ (1) Unemployment Insurance Benefit Claims and Litigation.

The timely processing of unemployment benefit claims:

(a) Employee separation and wage requests

(b) Benefit appeals; employer charge protests

________ (2) Tax matters.

(a) Employer registrations; account updates

(b) Filing and payment of taxes related to employer liability to the District of Columbia

(c) Tax appeals

THIS POWER OF ATTORNEY IS EFECTIVE BEGINNING ____________ AND WILL EXPIRE ON ______________.

MM/DD/YYYY

MM/DD/YYYY

I agree that any third party who receives a copy of this document may act under it. Revocation of the power of attorney is not effective as to a third

party until the third party learns of the revocation. I agree to indemnify the third party for any claims that arise against the third party because of

reliance on this power of attorney. Further, I agree that the power of attorney does not relieve my responsibilities outlined in Title 51 of the District of

Columbia Code.

Signed this ________ day of ______________, ________

_____________________________________________

Day

Month

Year

Signature (Employer)

Declaration of Representative: Representative(s) must complete this section and sign below.

Under penalties of perjury, I declare that:

I am not currently under suspension or disbarment from practice before the Internal Revenue Service (IRS).

I am aware of regulations contained in Treasury Department Circular #230, as amended, concerning the practice of attorneys, certified

public accountants, enrolled agents, enrolled actuaries, and others and the penalties for false or fraudulent statements provided in DC

Official Code 47-4106.

I am authorized to represent in the District of Columbia the taxpayer(s) identified for the tax matter(s) specified herein; and I am one of the

following:

(a) A member in good standing of the bar of the highest court of the jurisdiction shown below.

(b) A Certified Public Accountant duly qualified to practice in the jurisdiction shown below.

(c) An Enrolled Agent under the requirements of the Treasury Department Circular # 230.

(d) A bona fide officer of the taxpayer’s organization.

(e) A full-time employee of the taxpayer, trust, receivership, guardian or estate.

(f) A member of the taxpayer’s immediate family (i.e. spouse, parent, child, brother, or sister).

(g) An actuary enrolled by the Joint Board for the Enrollment of Actuaries (the authority to practice before IRS is limited by

Treasury Department Circular #230).

(h) An unenrolled return preparer under the requirements of Treasury Department Circular #230.

(i)

A general partner of a partnership.

(j) Other.

Designation – Inset above letter (a-j)

Jurisdiction (state)

Signature

Date

Form No.: OUCTAX-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1