Form 2106 And Pennsylvania Ue-1 Employee Business Expense Form

ADVERTISEMENT

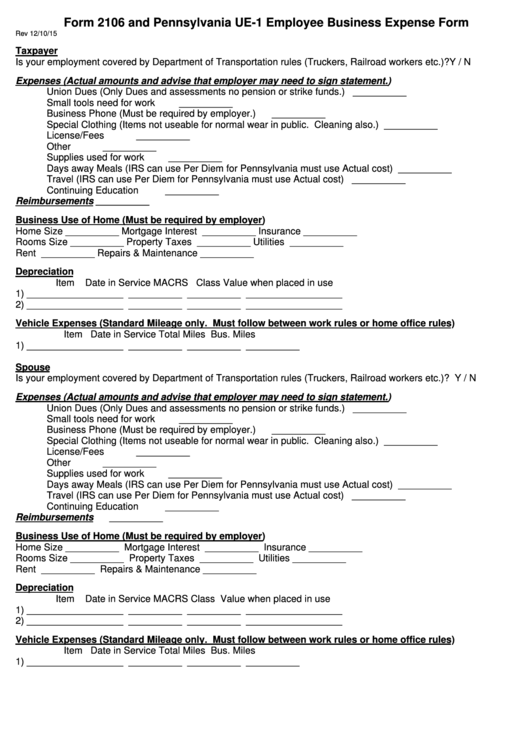

Form 2106 and Pennsylvania UE-1 Employee Business Expense Form

Rev 12/10/15

Taxpayer

Is your employment covered by Department of Transportation rules (Truckers, Railroad workers etc.)? Y / N

Expenses (Actual amounts and advise that employer may need to sign statement.)

Union Dues (Only Dues and assessments no pension or strike funds.)

__________

Small tools need for work

__________

Business Phone (Must be required by employer.)

__________

Special Clothing (Items not useable for normal wear in public. Cleaning also.)

__________

License/Fees

__________

Other

__________

Supplies used for work

__________

Days away Meals (IRS can use Per Diem for Pennsylvania must use Actual cost)

__________

Travel (IRS can use Per Diem for Pennsylvania must use Actual cost)

__________

Continuing Education

__________

Reimbursements

__________

Business Use of Home (Must be required by employer)

Home Size

__________ Mortgage Interest

__________ Insurance

__________

Rooms Size

__________ Property Taxes

__________ Utilities

__________

Rent

__________ Repairs & Maintenance

__________

Depreciation

Item

Date in Service

MACRS

Class Value when placed in use

1) __________________

__________

__________

__________________

2) __________________

__________

__________

__________________

Vehicle Expenses (Standard Mileage only. Must follow between work rules or home office rules)

Item

Date in Service

Total Miles

Bus. Miles

1) __________________

__________

__________

__________

Spouse

Is your employment covered by Department of Transportation rules (Truckers, Railroad workers etc.)? Y / N

Expenses (Actual amounts and advise that employer may need to sign statement.)

Union Dues (Only Dues and assessments no pension or strike funds.)

__________

Small tools need for work

__________

Business Phone (Must be required by employer.)

__________

Special Clothing (Items not useable for normal wear in public. Cleaning also.)

__________

License/Fees

__________

Other

__________

Supplies used for work

__________

Days away Meals (IRS can use Per Diem for Pennsylvania must use Actual cost)

__________

Travel (IRS can use Per Diem for Pennsylvania must use Actual cost)

__________

Continuing Education

__________

Reimbursements

__________

Business Use of Home (Must be required by employer)

Home Size

__________

Mortgage Interest

__________

Insurance

__________

Rooms Size

__________

Property Taxes

__________

Utilities __________

Rent

__________

Repairs & Maintenance

__________

Depreciation

Item

Date in Service

MACRS Class

Value when placed in use

1) __________________

__________

__________

__________________

2) __________________

__________

__________

__________________

Vehicle Expenses (Standard Mileage only. Must follow between work rules or home office rules)

Item

Date in Service

Total Miles

Bus. Miles

1) __________________

__________

__________

__________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1