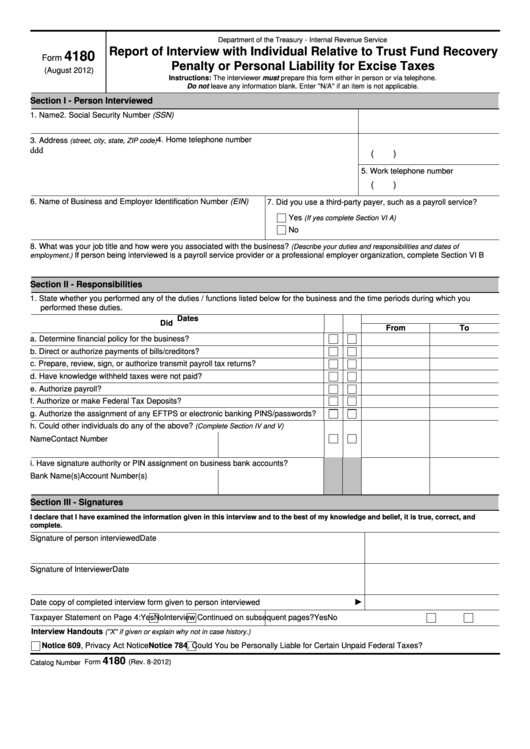

Department of the Treasury - Internal Revenue Service

Report of Interview with Individual Relative to Trust Fund Recovery

4180

Form

Penalty or Personal Liability for Excise Taxes

(August 2012)

Instructions: The interviewer must prepare this form either in person or via telephone.

Do not leave any information blank. Enter ''N/A'' if an item is not applicable.

Section I - Person Interviewed

1. Name

2. Social Security Number (SSN)

4. Home telephone number

3. Address

(street, city, state, ZIP code)

ddd

(

)

5. Work telephone number

(

)

6. Name of Business and Employer Identification Number (EIN)

7. Did you use a third-party payer, such as a payroll service?

Yes

(If yes complete Section VI A)

No

8. What was your job title and how were you associated with the business?

(Describe your duties and responsibilities and dates of

If person being interviewed is a payroll service provider or a professional employer organization, complete Section VI B

employment.)

Section II - Responsibilities

1. State whether you performed any of the duties / functions listed below for the business and the time periods during which you

performed these duties.

Dates

Did you...

Yes No

From

To

a. Determine financial policy for the business?

b. Direct or authorize payments of bills/creditors?

c. Prepare, review, sign, or authorize transmit payroll tax returns?

d. Have knowledge withheld taxes were not paid?

e. Authorize payroll?

f. Authorize or make Federal Tax Deposits?

g. Authorize the assignment of any EFTPS or electronic banking PINS/passwords?

h. Could other individuals do any of the above?

(Complete Section IV and V)

Name

Contact Number

i. Have signature authority or PIN assignment on business bank accounts?

Bank Name(s)

Account Number(s)

Section III - Signatures

I declare that I have examined the information given in this interview and to the best of my knowledge and belief, it is true, correct, and

complete.

Signature of person interviewed

Date

Signature of Interviewer

Date

►

Date copy of completed interview form given to person interviewed

Taxpayer Statement on Page 4:

Yes

No

Interview Continued on subsequent pages?

Yes

No

Interview Handouts

(''X'' if given or explain why not in case history.)

Notice 609, Privacy Act Notice

Notice 784, Could You be Personally Liable for Certain Unpaid Federal Taxes?

4180

Form

(Rev. 8-2012)

Catalog Number 22710P

1

1 2

2 3

3 4

4