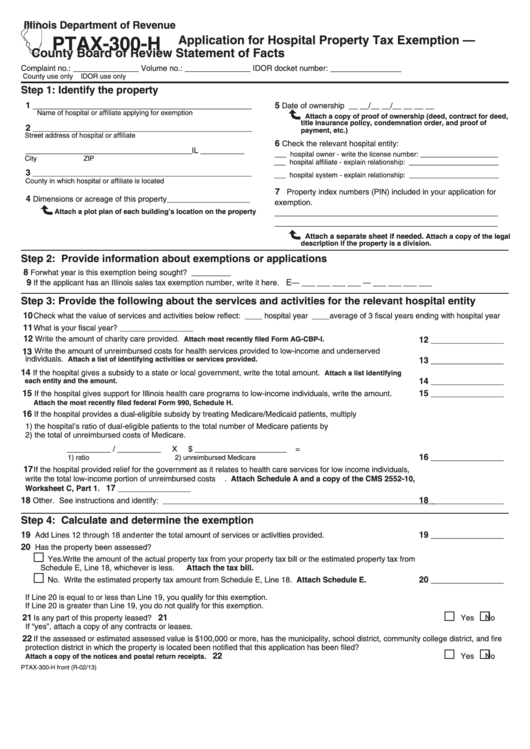

Ptax-300-H Form - Application For Hospital Property Tax Exemption - County Board Of Review Statement Of Facts

ADVERTISEMENT

Illinois Department of Revenue

PTAX-300-H

Application for Hospital Property Tax Exemption —

County Board of Review Statement of Facts

_______________

Complaint no.: _______________ Volume no.: _______________

IDOR docket number:

County use only

IDOR use only

Step 1: Identify the property

1

5

__________________________________________________

Date of ownership __ __/__ __/__ __ __ __

Name of hospital or affiliate applying for exemption

Attach a copy of proof of ownership (deed, contract for deed,

title insurance policy, condemnation order, and proof of

2

__________________________________________________

payment, etc.)

Street address of hospital or affiliate

6

Check the relevant hospital entity:

______________________________________IL __________

___ hospital owner - write the license number: ____________________

City

ZIP

___ hospital affiliate - explain relationship: _______________________

3

__________________________________________________

___ hospital system - explain relationship: _______________________

County in which hospital or affiliate is located

7

Property index numbers (PIN) included in your application for

4

Dimensions or acreage of this property___________________

exemption.

Attach a plot plan of each building’s location on the property

___________________________________________________

___________________________________________________

Attach a separate sheet if needed.

Attach a copy of the legal

description if the property is a division.

Step 2: Provide information about exemptions or applications

8

For what year is this exemption being sought? _________

9

E

If the applicant has an Illinois sales tax exemption number, write it here.

— ___ ___ ___ ___ — ___ ___ ___ ___

Step 3: Provide the following about the services and activities for the relevant hospital entity

10

Check what the value of services and activities below reflect: ____ hospital year ____average of 3 fiscal years ending with hospital year

11

What is your fiscal year? _________________

12

Write the amount of charity care provided.

12

Attach most recently filed Form AG-CBP-I.

_________________

13

Write the amount of unreimbursed costs for health services provided to low-income and underserved

individuals.

13

Attach a list of identifying activities or services provided.

_________________

14

If the hospital gives a subsidy to a state or local government, write the total amount.

Attach a list identifying

14

_________________

each entity and the amount.

15

15

If the hospital gives support for Illinois health care programs to low-income individuals, write the amount.

_________________

Attach the most recently filed federal Form 990, Schedule H.

16

If the hospital provides a dual-eligible subsidy by treating Medicare/Medicaid patients, multiply

1) the hospital’s ratio of dual-eligible patients to the total number of Medicare patients by

2) the total of unreimbursed costs of Medicare.

__________ / __________

X

$ _____________________

=

16

_________________

1) ratio

2) unreimbursed Medicare

17

If the hospital provided relief for the government as it relates to health care services for low income individuals,

write the total low-income portion of unreimbursed costs. Attach Schedule A and a copy of the CMS 2552-10,

17

Worksheet C, Part 1.

_________________

18

18

Other. See instructions and identify: ______________________________________________________________

_________________

Step 4: Calculate and determine the exemption

19

19

Add Lines 12 through 18 and enter the total amount of services or activities provided.

_________________

20

Has the property been assessed?

Yes. Write the amount of the actual property tax from your property tax bill or the estimated property tax from

Schedule E, Line 18, whichever is less. Attach the tax bill.

20

No. Write the estimated property tax amount from Schedule E, Line 18. Attach Schedule E.

_________________

If Line 20 is equal to or less than Line 19, you qualify for this exemption.

If Line 20 is greater than Line 19, you do not qualify for this exemption.

21

21

Is any part of this property leased?

Yes

No

If “yes”, attach a copy of any contracts or leases.

22

If the assessed or estimated assessed value is $100,000 or more, has the municipality, school district, community college district, and fire

protection district in which the property is located been notified that this application has been filed?

22

Yes

No

Attach a copy of the notices and postal return receipts.

PTAX-300-H front (R-02/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3