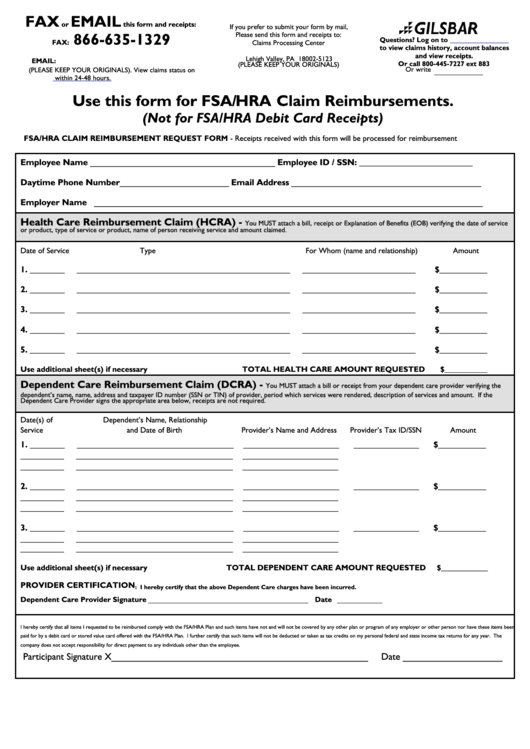

FAX

EMAIL

or

this form and receipts:

If you prefer to submit your form by mail,

866-635-1329

Please send this form and receipts to:

Questions? Log on to

FAX:

Claims Processing Center

to view claims history, account balances

P.O. Box 25123

and view receipts.

Lehigh Valley, PA 18002-5123

EMAIL:

Or call 800-445-7227 ext 883

(PLEASE KEEP YOUR ORIGINALS)

(PLEASE KEEP YOUR ORIGINALS). View claims status on

Or write

within 24-48 hours.

Use this form for FSA/HRA Claim Reimbursements.

(Not for FSA/HRA Debit Card Receipts)

FSA/HRA CLAIM REIMBURSEMENT REQUEST FORM - Receipts received with this form will be processed for reimbursement

Employee Name _______________________________________ Employee ID / SSN: __________________________

Daytime Phone Number_______________________ Email Address ________________________________________

Employer Name __________________________________________________________________________________

Health Care Reimbursement Claim (HCRA) -

You MUST attach a bill, receipt or Explanation of Benefits (EOB) verifying the date of service

or product, type of service or product, name of person receiving service and amount claimed.

Date of Service

Type

For Whom (name and relationship)

Amount

1. ________

_________________________________________________

__________________________

$___________

2. ________

_________________________________________________

__________________________

$___________

3. ________

_________________________________________________

__________________________

$___________

4. ________

_________________________________________________

__________________________

$___________

5. ________

_________________________________________________

__________________________

$___________

Use additional sheet(s) if necessary

TOTAL HEALTH CARE AMOUNT REQUESTED

$___________

Dependent Care Reimbursement Claim (DCRA) -

You MUST attach a bill or receipt from your dependent care provider verifying the

dependent’s name, name, address and taxpayer ID number (SSN or TIN) of provider, period which services were rendered, description of services and amount. If the

Dependent Care Provider signs the appropriate area below, receipts are not required.

Date(s) of

Dependent’s Name, Relationship

Service

and Date of Birth

Provider’s Name and Address

Provider’s Tax ID/SSN

Amount

1. ________

____________________________________

______________________

_______________

$___________

__________

____________________________________

______________________

__________

____________________________________

______________________

2. ________

____________________________________

______________________

_______________

$___________

__________

____________________________________

______________________

__________

____________________________________

______________________

3. ________

____________________________________

______________________

_______________

$___________

__________

____________________________________

______________________

__________

____________________________________

______________________

Use additional sheet(s) if necessary

TOTAL DEPENDENT CARE AMOUNT REQUESTED

$____________

PROVIDER CERTIFICATION

: I hereby certify that the above Dependent Care charges have been incurred.

Dependent Care Provider Signature

Date

_____________________________________________________

_______________

I hereby certify that all items I requested to be reimbursed comply with the FSA/HRA Plan and such items have not and will not be covered by any other plan or program of any employer or other person nor have these items been

paid for by a debit card or stored value card offered with the FSA/HRA Plan. I further certify that such items will not be deducted or taken as tax credits on my personal federal and state income tax returns for any year. The

company does not accept responsibility for direct payment to any individuals other than the employee.

Participant Signature X_________________________________________________

Date ___________________

1

1