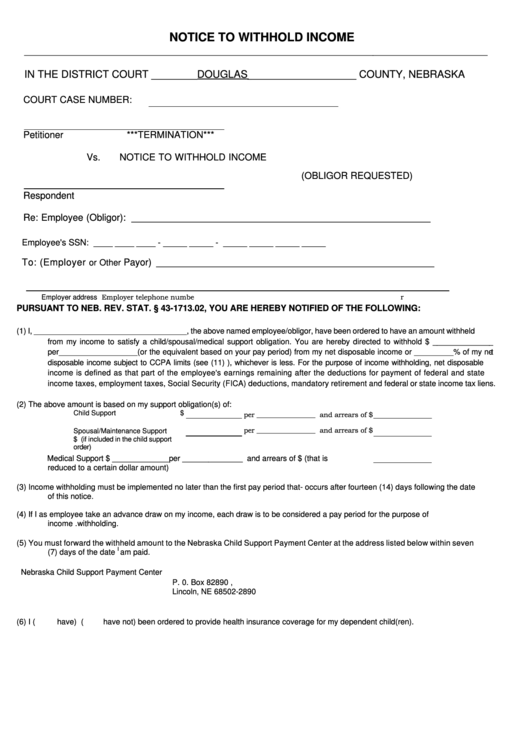

NOTICE TO WITHHOLD INCOME

_________________________________________________________________________________

IN THE DISTRICT COURT ________DOUGLAS___________________ COUNTY, NEBRASKA

COURT CASE NUMBER:

Petitioner

***TERMINATION***

Vs.

NOTICE TO WITHHOLD INCOME

(OBLIGOR REQUESTED)

Respondent

Re: Employee (Obligor): _________________________________________________________

Employee's SSN: ____ ____ ____ - _____ _____ - _____ _____ _____ _____

To: (Employer

Payor) _____________________________________________________

or Other

Employer telephone number

Employer address

PURSUANT TO NEB. REV. STAT. § 43-1713.02, YOU ARE HEREBY NOTIFIED OF THE FOLLOWING:

(1)

I, ___________________________________, the above named employee/obligor, have been ordered to have an amount withheld

from my income to satisfy a child/spousal/medical support obligation. You are hereby directed to withhold $ ______________

per__________________(or the equivalent based on your pay period) from my net disposable income or _________% of my net

disposable income subject to CCPA limits (see (11) ), whichever is less. For the purpose of income withholding, net disposable

income is defined as that part of the employee's earnings remaining after the deductions for payment of federal and state

income taxes, employment taxes, Social Security (FICA) deductions, mandatory retirement and federal or state income tax liens.

(2)

The above amount is based on my support obligation(s) of:

Child Support

$

per _________________ and arrears of $

per _________________ and arrears of $

Spousal/Maintenance Support

$ (if included in the child support

order)

Medical Support

$ _____________per ______________ and arrears of $ (that is

reduced to a certain dollar amount)

(3)

Income withholding must be implemented no later than the first pay period that- occurs after fourteen (14) days following the date

of this notice.

(4)

If I as employee take an advance draw on my income, each draw is to be considered a pay period for the purpose of

income .withholding.

(5)

You must forward the withheld amount to the Nebraska Child Support Payment Center at the address listed below within seven

I

(7) days of the date

am paid.

Nebraska Child Support Payment Center

P. 0. Box 82890 ,

Lincoln, NE 68502-2890

(6)

I (

have) (

have not) been ordered to provide health insurance coverage for my dependent child(ren).

1

1 2

2