Non Taxable Income Worksheet Template

ADVERTISEMENT

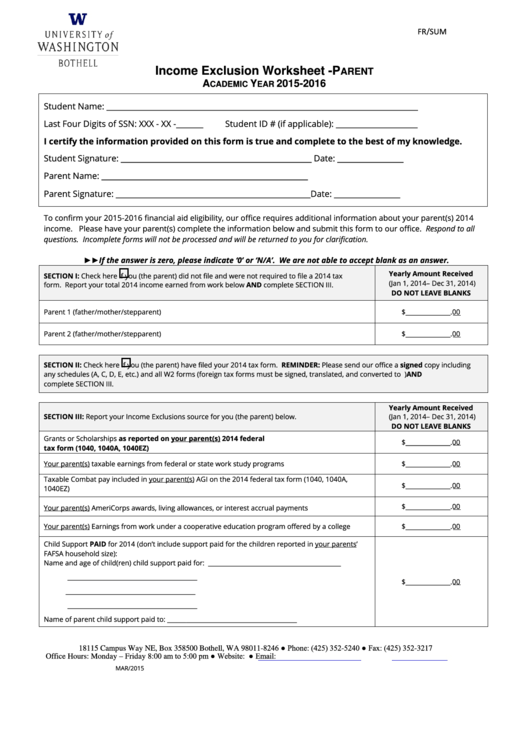

FR/SUM

Income Exclusion Worksheet - P

ARENT

A

Y

2015-2016

CADEMIC

EAR

Student Name: ________________________________________________________________________________

Last Four Digits of SSN: XXX - XX -_______

Student ID # (if applicable): _____________________

I certify the information provided on this form is true and complete to the best of my knowledge.

Student Signature: _________________________________________________

Date: _________________

Parent Name: _____________________________________________________

Parent Signature: __________________________________________________

Date: _________________

To confirm your 2015-2016 financial aid eligibility, our office requires additional information about your parent(s) 2014

income. Please have your parent(s) complete the information below and submit this form to our office. Respond to all

questions. Incomplete forms will not be processed and will be returned to you for clarification.

►►If the answer is zero, please indicate ‘0’ or ‘N/A’. We are not able to accept blank as an answer.

Yearly Amount Received

SECTION I: Check here

if you (the parent) did not file and were not required to file a 2014 tax

(Jan 1, 2014– Dec 31, 2014)

form. Report your total 2014 income earned from work below AND complete SECTION III.

DO NOT LEAVE BLANKS

Parent 1 (father/mother/stepparent)

$________________.00

Parent 2 (father/mother/stepparent)

$________________.00

SECTION II: Check here

if you (the parent) have filed your 2014 tax form. REMINDER: Please send our office a signed copy including

any schedules (A, C, D, E, etc.) and all W2 forms (foreign tax forms must be signed, translated, and converted to U.S. Dollars) AND

complete SECTION III.

Yearly Amount Received

SECTION III: Report your Income Exclusions source for you (the parent) below.

(Jan 1, 2014– Dec 31, 2014)

DO NOT LEAVE BLANKS

Grants or Scholarships as reported on your parent(s) 2014 federal

$________________.00

tax form (1040, 1040A, 1040EZ)

Your parent(s) taxable earnings from federal or state work study programs

$________________.00

Taxable Combat pay included in your parent(s) AGI on the 2014 federal tax form (1040, 1040A,

$________________.00

1040EZ)

$________________.00

Your parent(s) AmeriCorps awards, living allowances, or interest accrual payments

Your parent(s) Earnings from work under a cooperative education program offered by a college

$________________.00

Child Support PAID for 2014 (don’t include support paid for the children reported in your parents’

FAFSA household size):

Name and age of child(ren) child support paid for: __________________________________________

_________________________________________

$________________.00

_________________________________________

_________________________________________

Name of parent child support paid to: _________________________________________

18115 Campus Way NE, Box 358500 Bothell, WA 98011-8246 ● Phone: (425) 352-5240 ● Fax: (425) 352-3217

Office Hours: Monday – Friday 8:00 am to 5:00 pm ● Website:

● Email:

uwbfaid@uw.edu

MAR/2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1