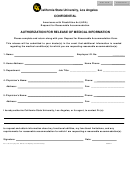

KSUF-2 Gift-In-Kind Form

Print Form

Date

DONOR INFORMATION

Donor ID # (if available)

Name

Address

City

State

Zip Code

GIFT DESCRIPTION

Provide Donor intended use, Equipment brand, Model #, Serial # and Condition of property. Attach Documentation

Men's:

Women's

___Slacks _______

__Shoes_______

__Slacks_______

__Sweaters_____

__Shoes_____

___Shirts _______

__Belts________

__Blouses______

__Jackets______

__ Belts______

___Ties ________

__Suit Coats____

__Suits ________

__Scarves______

___Vests_______

__Suits_______

__Dresses_______

__Coats________

GIFT VALUATION

Donor's Valuation of Gift:

BASIS FOR VALUATION OF GIFT

Sales Quotation or Invoice

Market Price

Outside Appraisal

Other (please describe)

NOTES TO DONOR(S):

KSU Foundation gratefully acknowledges your in-kind contribution. The following information is being provided for your convenience and does not constitute legal advice

on behalf of the KSU Foundation or its employees.

You are strongly encouraged to consult with your tax advisor:

* To claim a tax deduction for in-kind gifts valued between $500 and $5,000, the donor must complete Part I of IRS Form 8283 and attach it to their tax return

* For gifts that exceed $5,000, the donor must:

** Complete ALL parts of IRS Form 8283 and submit the complete form to KSU Foundation for a signature.

** Submit a certified appraisal dated no more than 60 days from the date of the donation. The appraisal must be prepared, signed and dated by a

qualified, third-party appraiser.

The value of any item, regardless of the amount, is used for internal gift reporting only--the KSU Foundation does not include the estimated value on a donor receipt or

acknowledgement. It is the responsibility of the donor to substantiate the fair market value for his/her own tax purposes.

My signature below verifies that I donated the property listed above to the Kansas State University Foundation. In doing so, I hereby

relinquish all claims to ownership of said property.

Donor's Signature

Date of Gift:

UNIVERSITY OFFICE

C19400

Career & Employment Services

Fund #

Fund Name

Sharon Fritzson

CES

532-1691

Person completing form

Department:

Campus Phone

Location of property recvd

Exempt use of property

Holtz Hall

Signature-Department Head

Date

Signature-Dean

Date

Kerri Day Keller, Director

Print Name-Dean

Print Name-Department Head

KSU Foundation Use Only

Donor #____________________ Gift Date____________________ Fund # ____________________ Campaign Code _________________

Account # _____4004/3105 Artwork (A)

_____4007/3108 Furnishings (G)

_____4001/3113 Rental Service (M)

_____4012/3109 Books & Pub (B)

_____4002/3112 Auto, Boat, Plane (J)

_____4201/3109 Construction (N)

_____4005/3106 Computer (D)

_____4009/3110 Prof Services (K)

_____4025/3109 Other (O)

_____4006/3107 Equipment (E)

_____4003/3111 Livestock (L)

Approved by ______________________________________

Date approved_____________________

KSU Foundation (REV 12/2010)

1

1 2

2 3

3