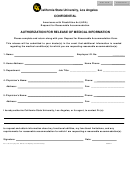

KSUF-2 Gift-In-Kind Form

Print Form

GIFT-IN-KIND ACCEPTANCE INSTRUCTIONS

In order to claim a gift of real or personal property (gift-in-kind) to KSU as a charitable tax deduction, the

donor must have an acknowledgment of the gift from the KSU Foundation. KSUF-2 Gift-In-Kind Form must

be completed by the KSU College or Department that receives the gift-in-kind property in order for the

KSU Foundation to process and acknowledge the gift.

The KSUF-2 Gift-In-Kind Form is divided into four sections as follows:

Donor Information

The

section requires the donor's name, address, date of gift and signature. In the case

it is not feasible to have the donor sign the form, a letter or note from the donor which confirms the gift and the

donor's intent must be attached to the KSUF-2 Gift-In-Kind form.

Gift Description

The

section is to identify the gifted property, confirm the donor's intended purpose for

the property and the amount or volume given. If equipment is donated, please also provide the identifying

information such as the equipment brand, model, serial number and the condition of the property (i.e. new,

used, or reconditioned). Please provide any available documentation from the donor, i.e. invoice, registration

papers, certification etc.

Gift Valuation

The

section is used to establish the value and the method of valuation for the gifted item(s).

The value assigned must be supported by adequate documentation, including invoices, outside appraisals,

price lists, etc. Gifts valued in excess of $5,000 (a single item or group of similar items) are required, by the

IRS, to be supported by a certified appraisal, completed within 60 days of the date of gift. The value assigned

will be used by the KSU Foundation to determine the gift credit amount. However, the amount will not be

noted on the gift receipt. The value allowed by the IRS for the tax deduction may be different from the gift

credit amount. The donor is encouraged to consult with their tax advisor concerning the deductible amounts

for each situation and to determine the documentation required by the IRS.

The KSU Foundation will acknowledge having received the gift by mailing a receipt to the donor. If the donor

submits a completed IRS Form 8283 (Noncash Charitable Contributions) to the Foundation, the Foundation

will sign and return the form to the donor. Additionally, the KSU Foundation is required by the IRS to file an

IRS Form 8282 (Donee Information Return) for gifted items valued at more than $5,000, if the property is

sold or disposed of within three (3) years of the date of the gift. The donor(s) will receive a copy of the 8282

which will list the "Amount Received Upon Disposition." This does not apply to gifted items that are consumed

while fulfilling the University related purpose.

The value of a gift of an automobile, boat or airplane will be limited to the gross proceeds from the sale of the

property by the Foundation.

University Office

The

section is to be completed by the receiving college or department. The department

should include the fund designation for the gift item(s), the purpose or intended use by the college and the

location of the property after receipt. The Dean and Department Head must acknowledge their acceptance

of the gift by signing in the "Approval Signature" line.

It is the responsibility of the college or department to report any gift-in-kind that may fall under the University's

inventory policy to the appropriate University official. For gifts of equipment, it is the University's policy that

approval be secured prior to accepting the gift.

KSU Foundation (REV 12/2010)

1

1 2

2 3

3