Application For Non Coverage Or Exemption City Financial Assistance Recipient

ADVERTISEMENT

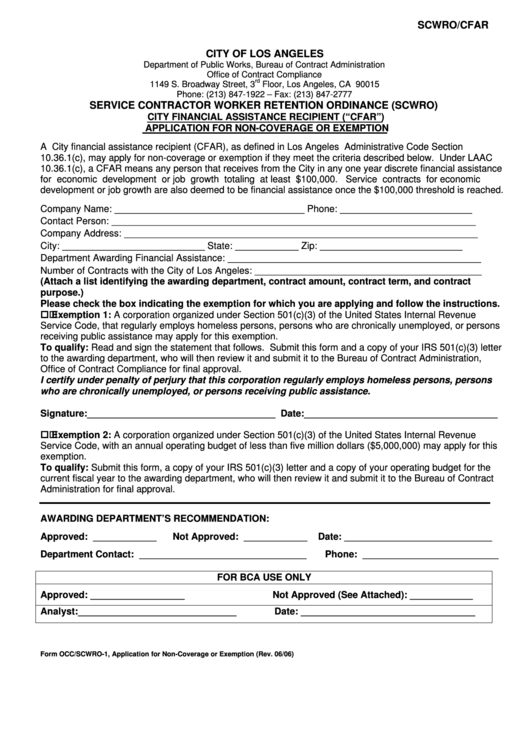

SCWRO/CFAR

CITY OF LOS ANGELES

Department of Public Works, Bureau of Contract Administration

Office of Contract Compliance

rd

1149 S. Broadway Street, 3

Floor, Los Angeles, CA 90015

Phone: (213) 847-1922 – Fax: (213) 847-2777

SERVICE CONTRACTOR WORKER RETENTION ORDINANCE (SCWRO)

CITY FINANCIAL ASSISTANCE RECIPIENT (“CFAR”)

APPLICATION FOR NON-COVERAGE OR EXEMPTION

A City financial assistance recipient (CFAR), as defined in Los Angeles Administrative Code Section

10.36.1(c), may apply for non-coverage or exemption if they meet the criteria described below. Under LAAC

10.36.1(c), a CFAR means any person that receives from the City in any one year discrete financial assistance

for economic development or job growth totaling at least $100,000.

Service contracts for economic

development or job growth are also deemed to be financial assistance once the $100,000 threshold is reached.

Company Name: ____________________________________ Phone: _________________________

Contact Person: _____________________________________________________________________

Company Address: ___________________________________________________________________

City: ___________________________

State: ____________

Zip: ___________________________

Department Awarding Financial Assistance: ________________________________________________

Number of Contracts with the City of Los Angeles: ___________________________________________

(Attach a list identifying the awarding department, contract amount, contract term, and contract

purpose.)

Please check the box indicating the exemption for which you are applying and follow the instructions.

Exemption 1: A corporation organized under Section 501(c)(3) of the United States Internal Revenue

Service Code, that regularly employs homeless persons, persons who are chronically unemployed, or persons

receiving public assistance may apply for this exemption.

To qualify: Read and sign the statement that follows. Submit this form and a copy of your IRS 501(c)(3) letter

to the awarding department, who will then review it and submit it to the Bureau of Contract Administration,

Office of Contract Compliance for final approval.

I certify under penalty of perjury that this corporation regularly employs homeless persons, persons

who are chronically unemployed, or persons receiving public assistance.

Signature:____________________________________ Date:_____________________________________

Exemption 2: A corporation organized under Section 501(c)(3) of the United States Internal Revenue

Service Code, with an annual operating budget of less than five million dollars ($5,000,000) may apply for this

exemption.

To qualify: Submit this form, a copy of your IRS 501(c)(3) letter and a copy of your operating budget for the

current fiscal year to the awarding department, who will then review it and submit it to the Bureau of Contract

Administration for final approval.

AWARDING DEPARTMENT’S RECOMMENDATION:

Approved: ____________

Not Approved: ____________ Date: ____________________________

Department Contact: ________________________________

Phone: __________________________

FOR BCA USE ONLY

Approved: __________________

Not Approved (See Attached): ____________

Analyst:______________________________

Date: _________________________________

Form OCC/SCWRO-1, Application for Non-Coverage or Exemption (Rev. 06/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1