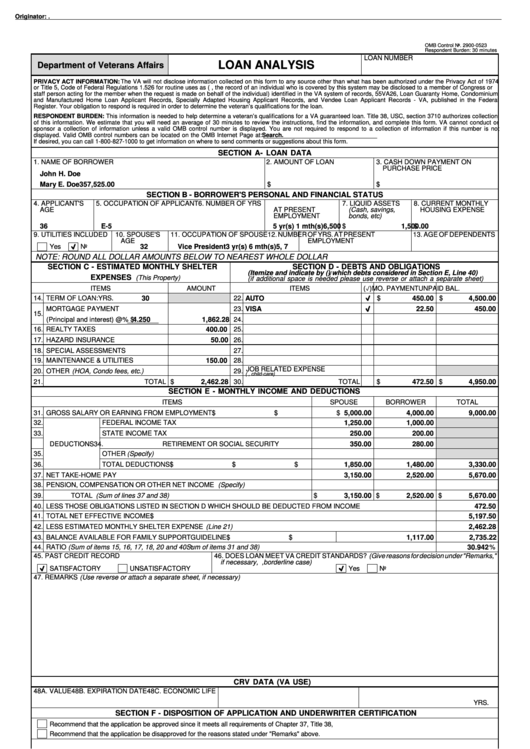

Loan Analysis

ADVERTISEMENT

Originator: .

OMB Control No. 2900-0523

Respondent Burden: 30 minutes

LOAN NUMBER

LOAN ANALYSIS

Department of Veterans Affairs

PRIVACY ACT INFORMATION:

The VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974

or Title 5, Code of Federal Regulations 1.526 for routine uses as (i.e., the record of an individual who is covered by this system may be disclosed to a member of Congress or

staff person acting for the member when the request is made on behalf of the individual) identified in the VA system of records, 55VA26, Loan Guaranty Home, Condominium

and Manufactured Home Loan Applicant Records, Specially Adapted Housing Applicant Records, and Vendee Loan Applicant Records - VA, published in the Federal

Register. Your obligation to respond is required in order to determine the veteran’s qualifications for the loan.

RESPONDENT BURDEN:

This information is needed to help determine a veteran’s qualifications for a VA guaranteed loan. Title 38, USC, section 3710 authorizes collection

of this information. We estimate that you will need an average of 30 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or

sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not

displayed. Valid OMB control numbers can be located on the OMB Internet Page at:

If desired, you can call 1-800-827-1000 to get information on where to send comments or suggestions about this form.

SECTION A - LOAN DATA

1. NAME OF BORROWER

2. AMOUNT OF LOAN

3. CASH DOWN PAYMENT ON

PURCHASE PRICE

John H. Doe

Mary E. Doe

357,525.00

$

$

SECTION B - BORROWER'S PERSONAL AND FINANCIAL STATUS

4. APPLICANT'S

5. OCCUPATION OF APPLICANT

6. NUMBER OF YRS

7. LIQUID ASSETS

8. CURRENT MONTHLY

AGE

AT PRESENT

(Cash, savings,

HOUSING EXPENSE

EMPLOYMENT

bonds, etc)

36

E-5

5 yr(s) 1 mth(s)

6,500

1,500.00

$

$

9. UTILITIES INCLUDED

10. SPOUSE'S

11. OCCUPATION OF SPOUSE

12. NUMBER OF YRS. AT PRESENT

13. AGE OF DEPENDENTS

AGE

EMPLOYMENT

Yes

No

32

Vice President

3 yr(s) 6 mth(s)

5, 7

NOTE: ROUND ALL DOLLAR AMOUNTS BELOW TO NEAREST WHOLE DOLLAR

SECTION C - ESTIMATED MONTHLY SHELTER

SECTION D - DEBTS AND OBLIGATIONS

(Itemize and indicate by ( ) which debts considered in Section E, Line 40)

EXPENSES

(This Property)

(if additional space is needed please use reverse or attach a separate sheet)

ITEMS

AMOUNT

ITEMS

( )

MO. PAYMENT

UNPAID BAL.

14. TERM OF LOAN:

30

YRS.

22.

AUTO

$

450.00

$

4,500.00

VISA

22.50

450.00

MORTGAGE PAYMENT

23.

15.

(Principal and interest) @

4.250

% $

1,862.28

24.

16. REALTY TAXES

400.00

25.

17. HAZARD INSURANCE

50.00

26.

18. SPECIAL ASSESSMENTS

27.

19. MAINTENANCE & UTILITIES

150.00

28.

29. JOB RELATED EXPENSE

20. OTHER

(HOA, Condo fees, etc.)

(e.g., child-care)

21.

TOTAL $

2,462.28

30.

TOTAL

$

472.50

$

4,950.00

SECTION E - MONTHLY INCOME AND DEDUCTIONS

ITEMS

SPOUSE

BORROWER

TOTAL

31. GROSS SALARY OR EARNING FROM EMPLOYMENT

$

5,000.00

$

4,000.00

$

9,000.00

32.

FEDERAL INCOME TAX

1,250.00

1,000.00

33.

STATE INCOME TAX

250.00

200.00

34.

DEDUCTIONS

RETIREMENT OR SOCIAL SECURITY

350.00

280.00

35.

OTHER

(Specify)

1,850.00

1,480.00

3,330.00

36.

TOTAL DEDUCTIONS

$

$

$

37. NET TAKE-HOME PAY

3,150.00

2,520.00

5,670.00

38. PENSION, COMPENSATION OR OTHER NET INCOME

(Specify)

39.

TOTAL

(Sum of lines 37 and 38)

$

3,150.00

$

2,520.00

$

5,670.00

472.50

40. LESS THOSE OBLIGATIONS LISTED IN SECTION D WHICH SHOULD BE DEDUCTED FROM INCOME

41. TOTAL NET EFFECTIVE INCOME

$

5,197.50

42. LESS ESTIMATED MONTHLY SHELTER EXPENSE

(Line 21)

2,462.28

43. BALANCE AVAILABLE FOR FAMILY SUPPORT

GUIDELINE $

1,117.00

$

2,735.22

:

44. RATIO

(Sum of items 15, 16, 17, 18, 20 and 40

Sum of items 31 and 38)

30.942

%

45. PAST CREDIT RECORD

46. DOES LOAN MEET VA CREDIT STANDARDS?

(Give reasons for decision under "Remarks,"

if necessary, e.g.,borderline case)

SATISFACTORY

UNSATISFACTORY

Yes

No

47. REMARKS

(Use reverse or attach a separate sheet, if necessary)

CRV DATA (VA USE)

48A. VALUE

48B. EXPIRATION DATE

48C. ECONOMIC LIFE

YRS.

SECTION F - DISPOSITION OF APPLICATION AND UNDERWRITER CERTIFICATION

Recommend that the application be approved since it meets all requirements of Chapter 37, Title 38, U.S. Code and applicable VA Regulations and directives

Recommend that the application be disapproved for the reasons stated under "Remarks" above.

The undersigned underwriter certifies that he/she personally reviewed and approved this loan.

(Loan was closed on the automatic basis.)

49. DATE

50. SIGNATURE OF EXAMINER/UNDERWRITER

51. FINAL ACTION

52. DATE

53. SIGNATURE AND TITLE OF APPROVING OFFICIAL

APPROVE

REJECT

APPLICATION

APPLICATION

VA FORM

EXISTING STOCK OF VA FORM 26-6393, SEP 2006,

Calyx Form - vala.frm (02/2013)

26-6393

NOV 2012

WILL BE USED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1