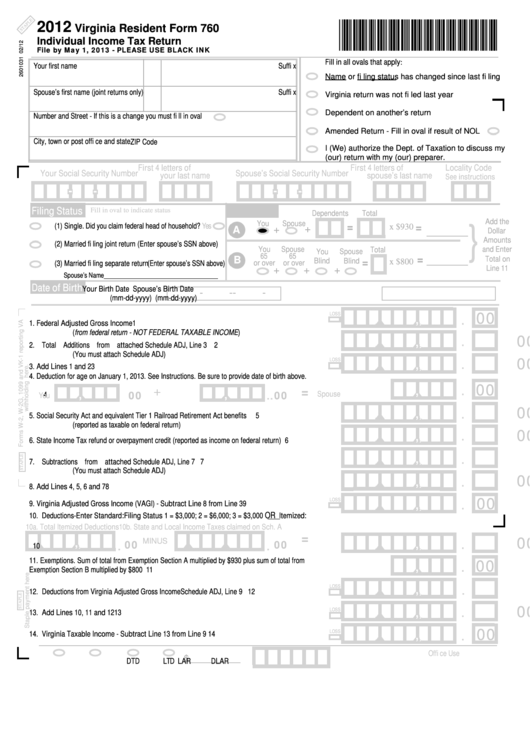

2012

Virginia Resident Form 760

Individual Income Tax Return

File by May 1, 2013 - PLEASE USE BLACK INK

Fill in all ovals that apply:

Your fi rst name

M.I.

Last name

Suffi x

Name or fi ling status has changed since last fi ling

Spouse’s fi rst name (joint returns only) M.I.

Last name

Suffi x

Virginia return was not fi led last year

Dependent on another’s return

Number and Street - If this is a change you must fi ll in oval

Amended Return - Fill in oval if result of NOL

City, town or post offi ce and state

ZIP Code

I (We) authorize the Dept. of Taxation to discuss my

(our) return with my (our) preparer.

First 4 letters of

First 4 letters of

Locality Code

Your Social Security Number

Spouse’s Social Security Number

your last name

spouse’s last name

See instructions

-

-

-

-

Filing Status

Exemptions

Fill in oval to indicate status

Dependents

Total

}

Add the

You

Spouse

(1) Single.

Did you claim federal head of household?

Yes

A

=

x $930

=

+

+

Dollar

Amounts

(2) Married fi ling joint return (Enter spouse’s SSN above)

You

Spouse

and Enter

Total

You

Spouse

65

65

B

Total on

=

Blind

Blind

(3) Married fi ling separate return (Enter spouse’s SSN above)

or over

or over

=

x $800

Line 11

+

+

+

Spouse’s Name____________________________________

Date of Birth

Your Birth Date

Spouse’s Birth Date

-

-

-

-

(mm-dd-yyyy)

(mm-dd-yyyy)

LOSS

,

,

00

.

1. Federal Adjusted Gross Income .................................................................................................1

(from federal return - NOT FEDERAL TAXABLE INCOME)

,

,

.

00

2. Total Additions from attached Schedule ADJ, Line 3 ...................................................................2

(You must attach Schedule ADJ)

LOSS

.

,

,

00

3. Add Lines 1 and 2 ........................................................................................................................3

4. Deduction for age on January 1, 2013. See Instructions. Be sure to provide date of birth above.

.

,

00

,

+

,

=

.

00

.

00

Spouse

4

You

,

,

.

00

5. Social Security Act and equivalent Tier 1 Railroad Retirement Act benefi ts ................................ 5

(reported as taxable on federal return)

.

,

,

00

6. State Income Tax refund or overpayment credit (reported as income on federal return) ...............6

,

,

,

,

.

00

7. Subtractions from attached Schedule ADJ, Line 7 .......................................................................7

(You must attach Schedule ADJ)

,

,

.

00

8. Add Lines 4, 5, 6 and 7 ................................................................................................................8

LOSS

,

,

.

00

9. Virginia Adjusted Gross Income (VAGI) - Subtract Line 8 from Line 3 ....................................9

OR

10. Deductions-Enter Standard: Filing Status 1 = $3,000; 2 = $6,000; 3 = $3,000

Itemized:

10a. Total Itemized Deductions

10b. State and Local Income Taxes claimed on Sch. A

=

,

,

,

,

00

00

,

,

.

00

MINUS

.

.

10

11. Exemptions. Sum of total from Exemption Section A multiplied by $930 plus sum of total from

,

.

00

Exemption Section B multiplied by $800 ...................................................................................... 11

,

,

LOSS

,

,

.

00

12. Deductions from Virginia Adjusted Gross Income Schedule ADJ, Line 9 ....................................12

,

,

.

00

LOSS

13. Add Lines 10, 11 and 12 ............................................................................................................13

LOSS

,

,

00

14. Virginia Taxable Income - Subtract Line 13 from Line 9 ........................................................14

.

Offi ce Use

_________

$

LAR

DLAR

DTD

LTD

1

1 2

2