Page 2

Your SSN

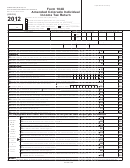

Form 760

-

-

2012

Year

,

,

00

.

15. Amount of Tax from Tax Table or Tax Rate Schedule (round to whole dollars) ...........................15

16. Spouse Tax Adjustment. For Filing Status 2 only. Enter VAGI in whole dollars below. See instructions.

.

00

16a - Enter Your VAGI below

16b - Enter Spouse’s VAGI below

16

LOSS

LOSS

.00

,

,

,

,

.00

,

,

00

.

17. Net Amount of Tax - Subtract Line 16 from Line 15 ...............................................................17

18. Virginia tax withheld for 2012.

.

,

,

00

18a. Your Virginia withholding ...................................................................................................18a

.

,

,

00

18b. Spouse’s Virginia withholding (fi ling status 2 only) ...........................................................18b

,

,

,

,

.

00

19. Estimated Tax Paid for tax year 2012 (from Form 760ES) ...........................................................19

(include overpayment credited from tax year 2011)

,

,

.

00

20. Extension Payments (from Form 760IP) ......................................................................................20

,

.

00

21. Tax Credit for Low Income Individuals or Earned Income Credit from attached Sch. ADJ, Line 17 .....21

,

,

.

00

22. Credit for Tax Paid to Another State from attached Sch. OSC, Line 21 ......................................22

(You must attach Sch. OSC and a copy of all other state returns)

,

,

.

00

23. Other Credits from attached Schedule CR ................................................................................23

(If claiming Political Contribution Credit only - fi ll in oval - see instructions)

,

,

.

00

24. Add Lines 18a, 18b and 19 through 23 ....................................................................................24

,

,

.

00

25. If Line 24 is less than Line 17, subtract Line 24 from Line 17. This is the Tax You Owe ............25

Skip to Line 28

,

,

.

00

26. If Line 17 is less than Line 24, subtract Line 17 from Line 24. This is Your Tax Overpayment ...26

,

,

.

00

27. Amount of overpayment you want credited to next year’s estimated tax ....................................27

,

,

.

00

28. Adjustments and Voluntary Contributions from attached Schedule ADJ, Line 24 .......................28

(You must attach Schedule ADJ)

,

,

.

00

29. Add Lines 27 and 28.....................................................................................................................29

30. If you owe tax on Line 25, add Lines 25 and 29. OR

If Line 26 is less than Line 29, subtract Line 26 from Line 29. AMOUNT YOU OWE ................30

,

,

.

00

-

FILL IN OVAL IF PAYING BY CREDIT OR DEBIT CARD

SEE INSTRUCTIONS

31. If Line 26 is greater than Line 29, subtract Line 29 from Line 26. YOUR REFUND ....................31

,

,

.

00

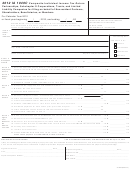

PAPER REFUND CHECKS WILL NOT BE ISSUED. Choose Debit Card or Direct Deposit below.

DEBIT CARD

DIRECT BANK DEPOSIT

OR

Your bank routing transit number

Type:

Fill in this oval if you want

Checking

to have your refund issued

Account number

Savings

on a prepaid debit card.

Qualifying farmer, fi sherman or merchant seaman

Federal Schedule C fi led with federal return

Fill in all

,

ovals that

Earned Income Credit from federal return. Amount claimed:

Overseas on due date

apply:

Primary Taxpayer Deceased

Spouse Deceased

I (We), the undersigned, declare under penalty of law that I (we) have examined this return and to the best of my (our) knowledge, it is a true, correct and complete return.

Your Signature

Date

Spouse’s Signature

Date

Your business phone number

Home phone number

Spouse’s business phone number

-

-

-

-

-

-

Filing

Preparer’s PTIN

Preparer’s Name

Firm Name

Phone Number

Election

1

1 2

2