Supplemental Property Tax Rebate Claim Form - State College Area

ADVERTISEMENT

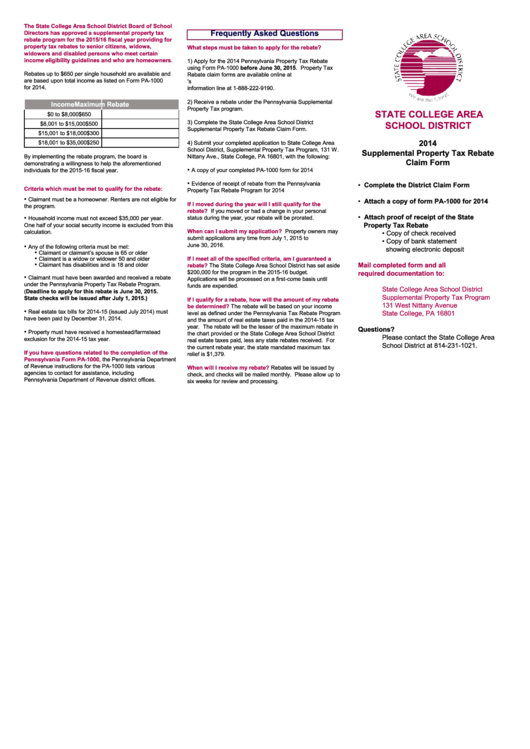

The State College Area School District Board of School

Frequently Asked Questions

Directors has approved a supplemental property tax

rebate program for the 2015/16 fiscal year providing for

property tax rebates to senior citizens, widows,

What steps must be taken to apply for the rebate?

widowers and disabled persons who meet certain

income eligibility guidelines and who are homeowners.

1) Apply for the 2014 Pennsylvania Property Tax Rebate

using Form PA-1000 before June 30, 2015. Property Tax

Rebates up to $650 per single household are available and

Rebate claim forms are available online at

are based upon total income as listed on Form PA-1000

or by calling the department’s

for 2014.

information line at 1-888-222-9190.

2) Receive a rebate under the Pennsylvania Supplemental

Income

Maximum Rebate

Property Tax program.

STATE COLLEGE AREA

$0 to $8,000

$650

3) Complete the State College Area School District

SCHOOL DISTRICT

$8,001 to $15,000

$500

Supplemental Property Tax Rebate Claim Form.

$15,001 to $18,000

$300

2014

$18,001 to $35,000

$250

4) Submit your completed application to State College Area

School District, Supplemental Property Tax Program, 131 W.

Supplemental Property Tax Rebate

By implementing the rebate program, the board is

Nittany Ave., State College, PA 16801, with the following:

Claim Form

demonstrating a willingness to help the aforementioned

•

A copy of your completed PA-1000 form for 2014

individuals for the 2015-16 fiscal year.

•

Evidence of receipt of rebate from the Pennsylvania

• Complete the District Claim Form

Criteria which must be met to qualify for the rebate:

Property Tax Rebate Program for 2014

•

Claimant must be a homeowner. Renters are not eligible for

• Attach a copy of form PA-1000 for 2014

If I moved during the year will I still qualify for the

the program.

rebate?

If you moved or had a change in your personal

• Attach proof of receipt of the State

•

status during the year, your rebate will be prorated.

Household income must not exceed $35,000 per year.

Property Tax Rebate

One half of your social security income is excluded from this

When can I submit my application?

Property owners may

calculation.

• Copy of check received

submit applications any time from July 1, 2015 to

• Copy of bank statement

June 30, 2016.

•

Any of the following criteria must be met:

showing electronic deposit

•

Claimant or claimant’s spouse is 65 or older

•

Claimant is a widow or widower 50 and older

If I meet all of the specified criteria, am I guaranteed a

•

Claimant has disabilities and is 18 and older

Mail completed form and all

rebate?

The State College Area School District has set aside

$200,000 for the program in the 2015-16 budget.

required documentation to:

•

Claimant must have been awarded and received a rebate

Applications will be processed on a first-come basis until

under the Pennsylvania Property Tax Rebate Program.

funds are expended.

State College Area School District

(Deadline to apply for this rebate is June 30, 2015.

Supplemental Property Tax Program

State checks will be issued after July 1, 2015.)

If I qualify for a rebate, how will the amount of my rebate

131 West Nittany Avenue

be determined?

The rebate will be based on your income

•

Real estate tax bills for 2014-15 (issued July 2014) must

State College, PA 16801

level as defined under the Pennsylvania Tax Rebate Program

have been paid by December 31, 2014.

and the amount of real estate taxes paid in the 2014-15 tax

year. The rebate will be the lesser of the maximum rebate in

Questions?

•

Property must have received a homestead/farmstead

the chart provided or the State College Area School District

Please contact the State College Area

exclusion for the 2014-15 tax year.

real estate taxes paid, less any state rebates received. For

School District at 814-231-1021.

the current rebate year, the state mandated maximum tax

If you have questions related to the completion of the

relief is $1,379.

Pennsylvania Form PA-1000,

the Pennsylvania Department

of Revenue instructions for the PA-1000 lists various

When will I receive my rebate?

Rebates will be issued by

agencies to contact for assistance, including

check, and checks will be mailed monthly. Please allow up to

Pennsylvania Department of Revenue district offices.

six weeks for review and processing.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2