Form T-77 - Estate Tax Credit Transmittal

ADVERTISEMENT

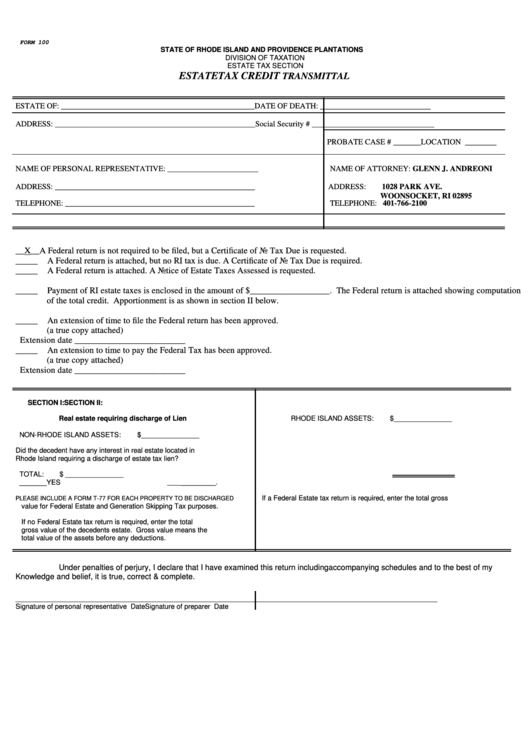

FORM 100

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

DIVISION OF TAXATION

ESTATE TAX SECTION

ESTATE TAX CREDIT

TRANSMITTAL

ESTATE OF: _________________________________________________

DATE OF DEATH: ____________________________

ADDRESS: ___________________________________________________

Social Security # _______________________________

PROBATE CASE # _______

LOCATION ________

NAME OF PERSONAL REPRESENTATIVE: _______________________

NAME OF ATTORNEY: GLENN J. ANDREONI

ADDRESS: ___________________________________________________

ADDRESS:

1028 PARK AVE.

WOONSOCKET, RI 02895

TELEPHONE: ________________________________________________

TELEPHONE: 401-766-2100

__X__ A Federal return is not required to be filed, but a Certificate of No Tax Due is requested.

_____

A Federal return is attached, but no RI tax is due. A Certificate of No Tax Due is required.

_____

A Federal return is attached. A Notice of Estate Taxes Assessed is requested.

_____

Payment of RI estate taxes is enclosed in the amount of $__________________. The Federal return is attached showing computation

of the total credit. Apportionment is as shown in section II below.

_____

An extension of time to file the Federal return has been approved.

(a true copy attached)

Extension date _________________________

_____

An extension to time to pay the Federal Tax has been approved.

(a true copy attached)

Extension date _________________________

SECTION I:

SECTION II:

Real estate requiring discharge of Lien

RHODE ISLAND ASSETS:

$_______________

NON-RHODE ISLAND ASSETS:

$_______________

Did the decedent have any interest in real estate located in

Rhode Island requiring a discharge of estate tax lien?

TOTAL:

$ _______________

_______YES _________.

If a Federal Estate tax return is required, enter the total gross

PLEASE INCLUDE A FORM T-77 FOR EACH PROPERTY TO BE DISCHARGED

value for Federal Estate and Generation Skipping Tax purposes.

If no Federal Estate tax return is required, enter the total

gross value of the decedents estate. Gross value means the

total value of the assets before any deductions.

Under penalties of perjury, I declare that I have examined this return including accompanying schedules and to the best of my

Knowledge and belief, it is true, correct & complete.

_____________________________________________________

________________________________________________________

Signature of personal representative

Date

Signature of preparer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2