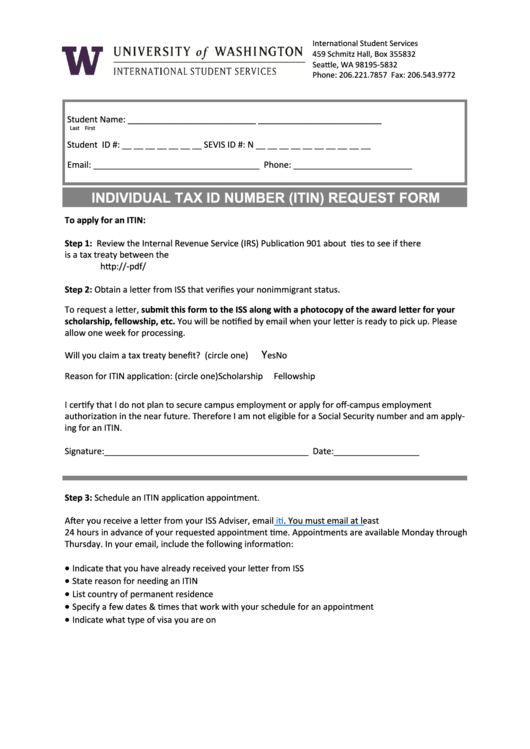

Individual Tax Id Number (Itin) Request Form - University Of Washington

ADVERTISEMENT

International Student Services

459 Schmitz Hall, Box 355832

Seattle, WA 98195-5832

Phone: 206.221.7857 Fax: 206.543.9772

iss.washington.edu

Student Name: ___________________________

__________________________

Last

First

Student ID #: __ __ __ __ __ __ __

SEVIS ID #: N __ __ __ __ __ __ __ __ __ __

Email: ___________________________________ Phone: _________________________

INDIVIDUAL TAX ID NUMBER (ITIN) REQUEST FORM

To apply for an ITIN:

Step 1: Review the Internal Revenue Service (IRS) Publication 901 about U.S. tax treaties to see if there

is a tax treaty between the U.S. and your home country.

Step 2: Obtain a letter from ISS that verifies your nonimmigrant status.

To request a letter, submit this form to the ISS along with a photocopy of the award letter for your

scholarship, fellowship, etc. You will be notified by email when your letter is ready to pick up. Please

allow one week for processing.

Y

Will you claim a tax treaty benefit? (circle one)

es

No

Reason for ITIN application: (circle one)

Scholarship

Fellowship

I certify that I do not plan to secure campus employment or apply for off-campus employment

authorization in the near future. Therefore I am not eligible for a Social Security number and am apply-

ing for an ITIN.

Signature:___________________________________________ Date:__________________

Step 3: Schedule an ITIN application appointment.

After you receive a letter from your ISS Adviser, email itin@u.washington.edu. You must email at least

24 hours in advance of your requested appointment time. Appointments are available Monday through

Thursday. In your email, include the following information:

Indicate that you have already received your letter from ISS

State reason for needing an ITIN

List country of permanent residence

Specify a few dates & times that work with your schedule for an appointment

Indicate what type of visa you are on

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1