Tax Id Request Form Allied Orion Group

ADVERTISEMENT

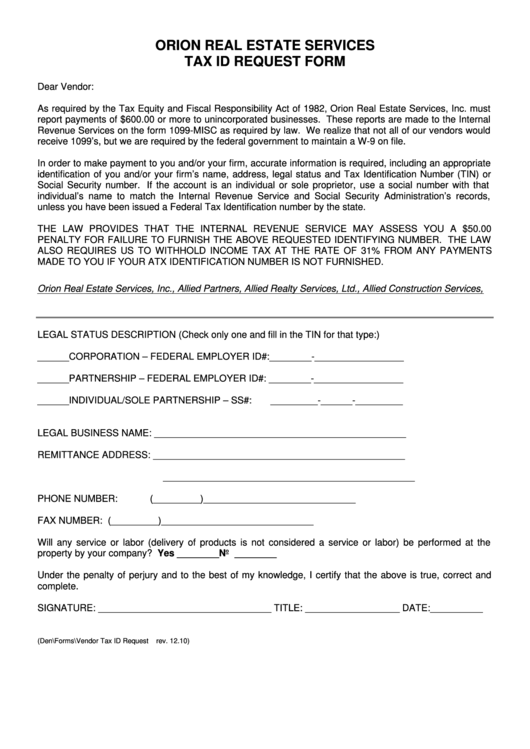

ORION REAL ESTATE SERVICES

TAX ID REQUEST FORM

Dear Vendor:

As required by the Tax Equity and Fiscal Responsibility Act of 1982, Orion Real Estate Services, Inc. must

report payments of $600.00 or more to unincorporated businesses. These reports are made to the Internal

Revenue Services on the form 1099-MISC as required by law. We realize that not all of our vendors would

receive 1099’s, but we are required by the federal government to maintain a W-9 on file.

In order to make payment to you and/or your firm, accurate information is required, including an appropriate

identification of you and/or your firm’s name, address, legal status and Tax Identification Number (TIN) or

Social Security number. If the account is an individual or sole proprietor, use a social number with that

individual’s name to match the Internal Revenue Service and Social Security Administration’s records,

unless you have been issued a Federal Tax Identification number by the state.

THE LAW PROVIDES THAT THE INTERNAL REVENUE SERVICE MAY ASSESS YOU A $50.00

PENALTY FOR FAILURE TO FURNISH THE ABOVE REQUESTED IDENTIFYING NUMBER. THE LAW

ALSO REQUIRES US TO WITHHOLD INCOME TAX AT THE RATE OF 31% FROM ANY PAYMENTS

MADE TO YOU IF YOUR ATX IDENTIFICATION NUMBER IS NOT FURNISHED.

Orion Real Estate Services, Inc., Allied Partners, Allied Realty Services, Ltd., Allied Construction Services,

LEGAL STATUS DESCRIPTION (Check only one and fill in the TIN for that type:)

______CORPORATION – FEDERAL EMPLOYER ID#:________-_________________

______PARTNERSHIP – FEDERAL EMPLOYER ID#: ________-_________________

______INDIVIDUAL/SOLE PARTNERSHIP – SS#:

_________-______-_________

LEGAL BUSINESS NAME:

________________________________________________

REMITTANCE ADDRESS:

________________________________________________

________________________________________________

PHONE NUMBER:

(_________)_____________________________

FAX NUMBER:

(_________)_____________________________

Will any service or labor (delivery of products is not considered a service or labor) be performed at the

property by your company? Yes ________No ________

Under the penalty of perjury and to the best of my knowledge, I certify that the above is true, correct and

complete.

SIGNATURE: _________________________________ TITLE: __________________ DATE:__________

(Den\Forms\Vendor Tax ID Request

rev. 12.10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1