Va Form 21-530 - Application For Burial Benefits (With Instructions)

ADVERTISEMENT

INSTRUCTIONS FOR COMPLETING APPLICATION FOR BURIAL BENEFITS

(UNDER 38 U.S.C., CHAPTER 23)

IMPORTANT - READ THESE INSTRUCTIONS CAREFULLY

1. RESPONDENT BURDEN: VA may not conduct or sponsor, and respondent is not required to respond to this collection of

information unless it displays a valid OMB Control Number. Public reporting burden for this collection of information is estimated to

average 22 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and

maintaining the data needed, and completing and reviewing the collection of information. If you have comments regarding this burden

estimate or any other aspect of this collection of information, call 1-800-827-1000 for mailing information on where to send your

comments.

PRIVACY ACT INFORMATION: The responses you submit are considered confidential, (38 U.S.C. 5701). They may be disclosed

outside the Department of Veterans Affairs (VA) only if the disclosure is authorized under the Privacy Act, including the routine uses

identified in the VA system of records, 58VA21/22/28, Compensation, Pension, Education and Vocational Rehabilitation and

Employment Records - VA, published in the Federal Register. The requested information is considered relevant and necessary to

determine maximum benefits under the law and is required to obtain benefits. Information submitted is subject to verification through

computer matching programs with other agencies.

2. GENERAL

a. BURIAL ALLOWANCE - An amount towards the expenses of the funeral and burial of the veteran's remains. Burial

includes all recognized methods of interment.

b. PLOT ALLOWANCE - Plot means the final resting place of the remains. The allowance is payable towards:

(1) Expenses incurred for the plot or interment if burial was not in a national cemetery or other cemetery under the

jurisdiction of the United States; OR

(2) Expenses payable to a State (or political subdivision) if the veteran died from nonservice-connected causes and was

buried in a State-owned cemetery or section used solely for the remains of persons eligible for burial in a national

cemetery.

c. BURIAL ALLOWANCE FOR SERVICE-CONNECTED DEATH - When the veteran's death occurred as the result of a

service-connected disability, a special "service-connected" rate is payable.

d. TRANSPORTATION EXPENSES - The cost of transporting the body to the place of burial may be paid in addition to

the burial allowance when:

(1) The veteran died of a service-connected disability or had a compensable service-connected disability and burial is in a

national cemetery; OR

(2) The veteran died while in a hospital, domiciliary or nursing home to which he/she had been properly admitted under

authority of VA; OR

(3) The veteran died en route while traveling under prior authorization of VA for the purpose of examination, treatment or care.

3. WHO SHOULD FILE A CLAIM

a. CREDITOR - If expenses have not been paid, the claim should be filed by the funeral director or crematory service by

completing Parts I, II, and IV. If the funeral director or crematory service has paid or advanced funds for or furnished the

plot or interment expenses, inclusion of these items on the statement of account will serve as claim for the plot allowance.

If cemetery owner or other creditor has not been paid for the plot and related interment expenses, he/she may file claim by

completing Parts I, III, and IV. If both the funeral director and cemetery owner are unpaid, each must submit a separate

VA Form 21-530 signed by the person who authorized services.

b. PERSON WHOSE FUNDS WERE USED - If all creditors have been paid, the claim should be filed by the person or

persons whose personal funds were used by completing Parts I, II, and IV.

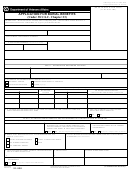

21-530

VA FORM

EXISTING STOCKS OF VA FORM 21-530,

JAN 2010

NOV 2008, WILL BE USED.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4