Form Hpw-4 - Employee'S Withholding Certificate For T Income Tax

ADVERTISEMENT

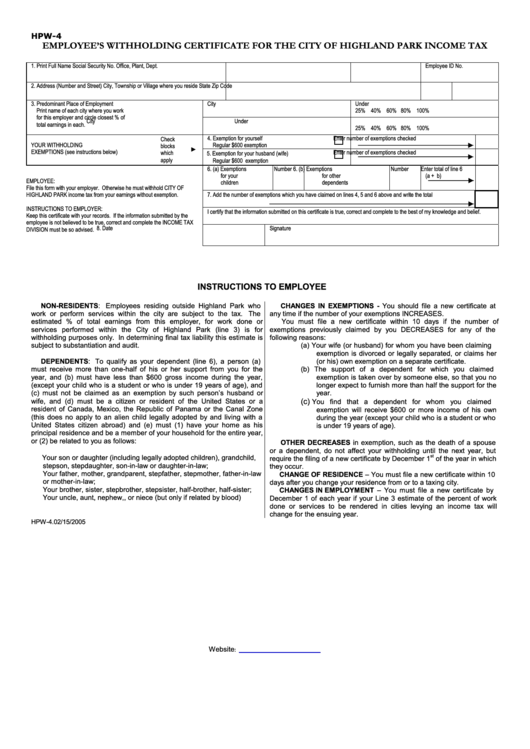

HPW-4

EMPLOYEE’S WITHHOLDING CERTIFICATE FOR THE CITY OF HIGHLAND PARK INCOME TAX

1. Print Full Name

Social Security No.

Office, Plant, Dept.

Employee ID No.

2. Address (Number and Street)

City, Township or Village where you reside

State

Zip Code

3. Predominant Place of Employment

City

Under

Print name of each city where you work

25% 40% 60% 80% 100%

for this employer and circle closest % of

City

Under

total earnings in each.

25% 40% 60% 80% 100%

4. Exemption for yourself

Enter number of exemptions checked

Check

YOUR WITHHOLDING

Regular $600 exemption

blocks

►

EXEMPTIONS (see instructions below)

Enter number of exemptions checked

which

5. Exemption for your husband (wife)

apply

Regular $600 exemption

6. (a) Exemptions

Number

6. (b) Exemptions

Number

Enter total of line 6

for your

for other

(a + b)

EMPLOYEE:

children

dependents

File this form with your employer. Otherwise he must withhold CITY OF

HIGHLAND PARK income tax from your earnings without exemption.

7. Add the number of exemptions which you have claimed on lines 4, 5 and 6 above and write the total

INSTRUCTIONS TO EMPLOYER:

I certify that the information submitted on this certificate is true, correct and complete to the best of my knowledge and belief.

Keep this certificate with your records. If the information submitted by the

employee is not believed to be true, correct and complete the INCOME TAX

8. Date

Signature

DIVISION must be so advised.

INSTRUCTIONS TO EMPLOYEE

NON-RESIDENTS: Employees residing outside Highland Park who

CHANGES IN EXEMPTIONS - You should file a new certificate at

work or perform services within the city are subject to the tax.

The

any time if the number of your exemptions INCREASES.

estimated % of total earnings from this employer, for work done or

You must file a new certificate within 10 days if the number of

services performed within the City of Highland Park (line 3) is for

exemptions previously claimed by you DECREASES for any of the

withholding purposes only. In determining final tax liability this estimate is

following reasons:

subject to substantiation and audit.

(a) Your wife (or husband) for whom you have been claiming

exemption is divorced or legally separated, or claims her

DEPENDENTS: To qualify as your dependent (line 6), a person (a)

(or his) own exemption on a separate certificate.

must receive more than one-half of his or her support from you for the

(b) The support of a dependent for which you claimed

year, and (b) must have less than $600 gross income during the year,

exemption is taken over by someone else, so that you no

(except your child who is a student or who is under 19 years of age), and

longer expect to furnish more than half the support for the

(c) must not be claimed as an exemption by such person’s husband or

year.

wife, and (d) must be a citizen or resident of the United States or a

(c)

You find that a dependent for whom you claimed

resident of Canada, Mexico, the Republic of Panama or the Canal Zone

exemption will receive $600 or more income of his own

(this does no apply to an alien child legally adopted by and living with a

during the year (except your child who is a student or who

United States citizen abroad) and (e) must (1) have your home as his

is under 19 years of age).

principal residence and be a member of your household for the entire year,

or (2) be related to you as follows:

OTHER DECREASES in exemption, such as the death of a spouse

or a dependent, do not affect your withholding until the next year, but

Your son or daughter (including legally adopted children), grandchild,

st

require the filing of a new certificate by December 1

of the year in which

stepson, stepdaughter, son-in-law or daughter-in-law;

they occur.

Your father, mother, grandparent, stepfather, stepmother, father-in-law

CHANGE OF RESIDENCE – You must file a new certificate within 10

or mother-in-law;

days after you change your residence from or to a taxing city.

Your brother, sister, stepbrother, stepsister, half-brother, half-sister;

CHANGES IN EMPLOYMENT – You must file a new certificate by

Your uncle, aunt, nephew,, or niece (but only if related by blood)

December 1 of each year if your Line 3 estimate of the percent of work

done or services to be rendered in cities levying an income tax will

change for the ensuing year.

HPW-4.02/15/2005

Website:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1