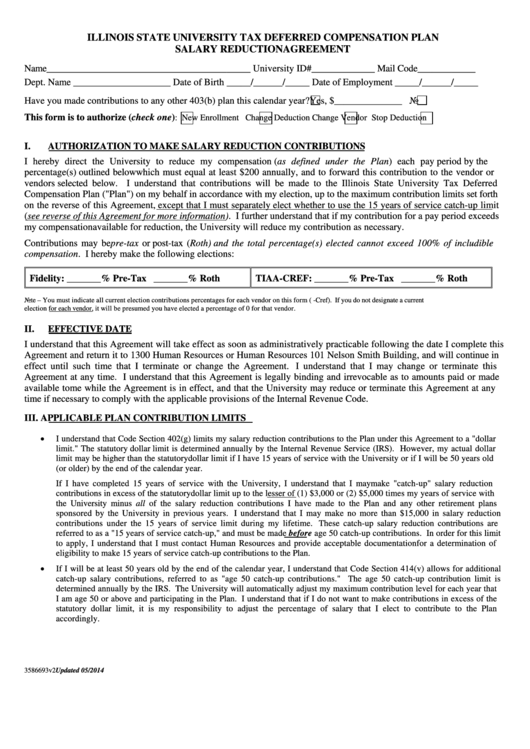

ILLINOIS STATE UNIVERSITY TAX DEFERRED COMPENSATION PLAN

SALARY REDUCTION AGREEMENT

Name__________________________________________ University ID#_____________ Mail Code____________

Dept. Name ____________________ Date of Birth _____/______/_____ Date of Employment _____/______/_____

Have you made contributions to any other 403(b) plan this calendar year?

Yes, $______________

No

This form is to authorize (check one)

:

New Enrollment

Change Deduction

Change Vendor

Stop Deduction

I.

AUTHORIZATION TO MAKE SALARY REDUCTION CONTRIBUTIONS

I hereby direct the University to reduce my compensation (as defined under the Plan) each pay period by the

percentage(s) outlined below which must equal at least $200 annually, and to forward this contribution to the vendor or

vendors selected below. I understand that contributions will be made to the Illinois State University Tax Deferred

Compensation Plan ("Plan") on my behalf in accordance with my election, up to the maximum contribution limits set forth

on the reverse of this Agreement, except that I must separately elect whether to use the 15 years of service catch-up limit

(see reverse of this Agreement for more information). I further understand that if my contribution for a pay period exceeds

my compensation available for reduction, the University will reduce my contribution as necessary.

Contributions may be pre-tax or post-tax (Roth) and the total percentage(s) elected cannot exceed 100% of includible

compensation. I hereby make the following elections:

Fidelity: _______% Pre-Tax _______% Roth

TIAA-CREF: _______% Pre-Tax _______% Roth

Note – You must indicate all current election contributions percentages for each vendor on this form (e.g. Fidelity and TIAA-Cref). If you do not designate a current

election for each vendor, it will be presumed you have elected a percentage of 0 for that vendor.

II.

EFFECTIVE DATE

I understand that this Agreement will take effect as soon as administratively practicable following the date I complete this

Agreement and return it to 1300 Human Resources or Human Resources 101 Nelson Smith Building, and will continue in

effect until such time that I terminate or change the Agreement. I understand that I may change or terminate this

Agreement at any time. I understand that this Agreement is legally binding and irrevocable as to amounts paid or made

available to me while the Agreement is in effect, and that the University may reduce or terminate this Agreement at any

time if necessary to comply with the applicable provisions of the Internal Revenue Code.

III. APPLICABLE PLAN CONTRIBUTION LIMITS

•

I understand that Code Section 402(g) limits my salary reduction contributions to the Plan under this Agreement to a "dollar

limit." The statutory dollar limit is determined annually by the Internal Revenue Service (IRS). However, my actual dollar

limit may be higher than the statutory dollar limit if I have 15 years of service with the University or if I will be 50 years old

(or older) by the end of the calendar year.

If I have completed 15 years of service with the University, I understand that I may make "catch-up" salary reduction

contributions in excess of the statutory dollar limit up to the lesser of (1) $3,000 or (2) $5,000 times my years of service with

the University minus all of the salary reduction contributions I have made to the Plan and any other retirement plans

sponsored by the University in previous years. I understand that I may make no more than $15,000 in salary reduction

contributions under the 15 years of service limit during my lifetime. These catch-up salary reduction contributions are

referred to as a "15 years of service catch-up," and must be made before age 50 catch-up contributions. In order for this limit

to apply, I understand that I must contact Human Resources and provide acceptable documentation for a determination of

eligibility to make 15 years of service catch-up contributions to the Plan.

•

If I will be at least 50 years old by the end of the calendar year, I understand that Code Section 414(v) allows for additional

catch-up salary contributions, referred to as "age 50 catch-up contributions." The age 50 catch-up contribution limit is

determined annually by the IRS. The University will automatically adjust my maximum contribution level for each year that

I am age 50 or above and participating in the Plan. I understand that if I do not want to make contributions in excess of the

statutory dollar limit, it is my responsibility to adjust the percentage of salary that I elect to contribute to the Plan

accordingly.

3586693v2

Updated 05/2014

1

1 2

2