Rollover Contribution Transmittal Instruction Form 401k

ADVERTISEMENT

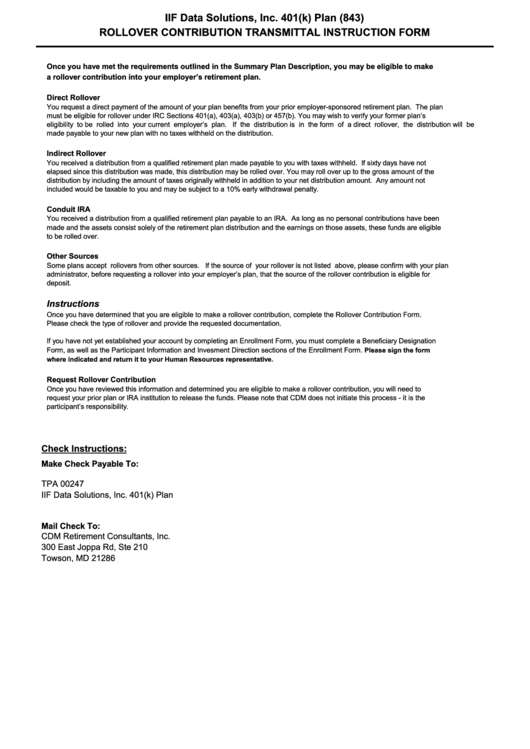

IIF Data Solutions, Inc. 401(k) Plan (843)

ROLLOVER CONTRIBUTION TRANSMITTAL INSTRUCTION FORM

Once you have met the requirements outlined in the Summary Plan Description, you may be eligible to make

a rollover contribution into your employer’s retirement plan.

Direct Rollover

You request a direct payment of the amount of your plan benefits from your prior employer-sponsored retirement plan.

The plan

must be eligible for rollover under IRC Sections 401(a), 403(a), 403(b) or 457(b). You may wish to verify your former plan’s

eligibility to be rolled into your current employer’s plan.

If the distribution is in the form of a direct rollover, the distribution will be

made payable to your new plan with no taxes withheld on the distribution.

Indirect Rollover

You received a distribution from a qualified retirement plan made payable to you with taxes withheld.

If sixty days have not

elapsed since this distribution was made, this distribution may be rolled over. You may roll over up to the gross amount of the

distribution by including the amount of taxes originally withheld in addition to your net distribution amount.

Any amount not

included would be taxable to you and may be subject to a 10% early withdrawal penalty.

Conduit IRA

You received a distribution from a qualified retirement plan payable to an IRA.

As long as no personal contributions have been

made and the assets consist solely of the retirement plan distribution and the earnings on those assets, these funds are eligible

to be rolled over.

Other Sources

Some plans accept rollovers from other sources.

If the source of your rollover is not listed above, please confirm with your plan

administrator, before requesting a rollover into your employer’s plan, that the source of the rollover contribution is eligible for

deposit.

Instructions

Once you have determined that you are eligible to make a rollover contribution, complete the Rollover Contribution Form.

Please check the type of rollover and provide the requested documentation.

If you have not yet established your account by completing an Enrollment Form, you must complete a Beneficiary Designation

Form, as well as the Participant Information and Invesment Direction sections of the Enrollment Form. Please sign the form

where indicated and return it to your Human Resources representative.

Request Rollover Contribution

Once you have reviewed this information and determined you are eligible to make a rollover contribution, you will need to

request your prior plan or IRA institution to release the funds. Please note that CDM does not initiate this process - it is the

participant’s responsibility.

Check Instructions:

Make Check Payable To:

M.G. Trust Company

TPA 00247

IIF Data Solutions, Inc. 401(k) Plan

Mail Check To:

CDM Retirement Consultants, Inc.

300 East Joppa Rd, Ste 210

Towson, MD 21286

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2