16 Tax Extension Filers - Student

Download a blank fillable 16 Tax Extension Filers - Student in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete 16 Tax Extension Filers - Student with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

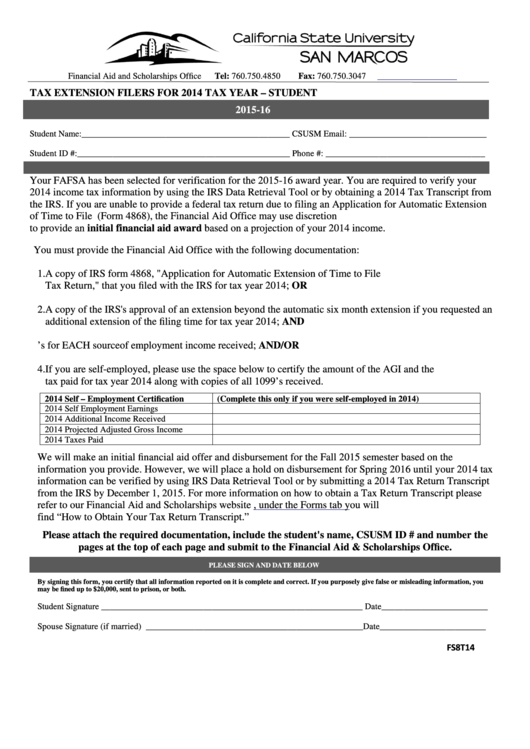

Financial Aid and Scholarships Office

Tel: 760.750.4850

Fax: 760.750.3047

TAX EXTENSION FILERS FOR 2014 TAX YEAR – STUDENT

2015-16

Student Name:_______________________________________________ CSUSM Email: _______________________________

Student ID #:________________________________________________ Phone #: ____________________________________

Your FAFSA has been selected for verification for the 2015-16 award year. You are required to verify your

2014 income tax information by using the IRS Data Retrieval Tool or by obtaining a 2014 Tax Transcript from

the IRS. If you are unable to provide a federal tax return due to filing an Application for Automatic Extension

of Time to File U.S. Individual Income Tax Return (Form 4868), the Financial Aid Office may use discretion

to provide an initial financial aid award based on a projection of your 2014 income.

You must provide the Financial Aid Office with the following documentation:

1.A copy of IRS form 4868, "Application for Automatic Extension of Time to File U.S. Individual Income

Tax Return," that you filed with the IRS for tax year 2014; OR

2.A copy of the IRS's approval of an extension beyond the automatic six month extension if you requested an

additional extension of the filing time for tax year 2014; AND

3.Copies of your 2014 W-2’s for EACH source of employment income received; AND/OR

4.If you are self-employed, please use the space below to certify the amount of the AGI and the U.S. income

tax paid for tax year 2014 along with copies of all 1099’s received.

2014 Self – Employment Certification

(Complete this only if you were self-employed in 2014)

2014 Self Employment Earnings

2014 Additional Income Received

2014 Projected Adjusted Gross Income

2014 Taxes Paid

We will make an initial financial aid offer and disbursement for the Fall 2015 semester based on the

information you provide. However, we will place a hold on disbursement for Spring 2016 until your 2014 tax

information can be verified by using IRS Data Retrieval Tool or by submitting a 2014 Tax Return Transcript

from the IRS by December 1, 2015. For more information on how to obtain a Tax Return Transcript please

refer to our Financial Aid and Scholarships website , under the Forms tab you will

find “How to Obtain Your Tax Return Transcript.”

Please attach the required documentation, include the student's name, CSUSM ID # and number the

pages at the top of each page and submit to the Financial Aid & Scholarships Office.

PLEASE SIGN AND DATE BELOW

By signing this form, you certify that all information reported on it is complete and correct. If you purposely give false or misleading information, you

may be fined up to $20,000, sent to prison, or both.

Student Signature ___________________________________________________________ Date________________________

Spouse Signature (if married) _________________________________________________ Date________________________

FS8T14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1