Form Rtc-60 - Renters' Tax Credit Application - 2015

ADVERTISEMENT

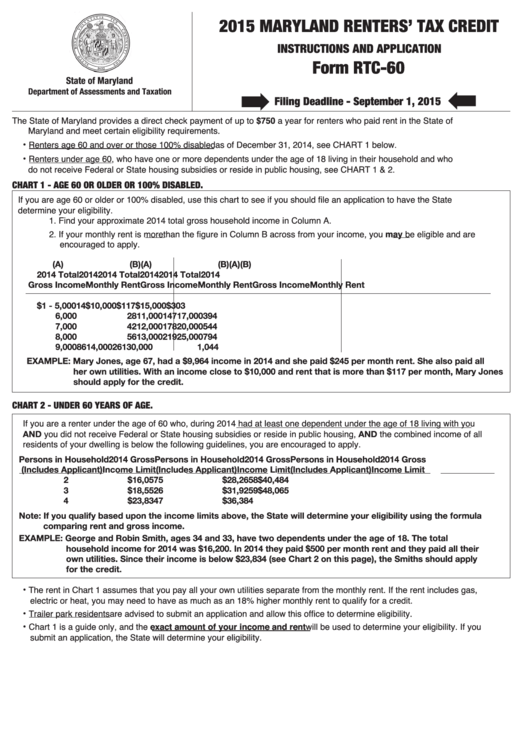

2015 MARYLAND RENTERS’ TAX CREDIT

INSTRUCTIONS AND APPLICATION

Form RTC-60

State of Maryland

·

Department of Assessments and Taxation

Filing Deadline - September 1, 2015

The State of Maryland provides a direct check payment of up to $750 a year for renters who paid rent in the State of

Maryland and meet certain eligibility requirements.

•

Renters age 60 and over or those 100% disabled as of December 31, 2014, see CHART 1 below.

•

Renters under age 60, who have one or more dependents under the age of 18 living in their household and who

do not receive Federal or State housing subsidies or reside in public housing, see CHART 1 & 2.

CHART 1 - AGE 60 OR OLDER OR 100% DISABLED.

If you are age 60 or older or 100% disabled, use this chart to see if you should file an application to have the State

determine your eligibility.

1. Find your approximate 2014 total gross household income in Column A.

2. If your monthly rent is more than the figure in Column B across from your income, you may be eligible and are

encouraged to apply.

(A)

(B)

(A)

(B)

(A)

(B)

2014 Total

2014

2014 Total

2014

2014 Total

2014

Gross Income

Monthly Rent

Gross Income

Monthly Rent

Gross Income

Monthly Rent

$1 - 5,000

14

$10,000

$117

$15,000

$303

6,000

28

11,000

147

17,000

394

7,000

42

12,000

178

20,000

544

8,000

56

13,000

219

25,000

794

9,000

86

14,000

261

30,000

1,044

EXAMPLE: Mary Jones, age 67, had a $9,964 income in 2014 and she paid $245 per month rent. She also paid all

her own utilities. With an income close to $10,000 and rent that is more than $117 per month, Mary Jones

should apply for the credit.

CHART 2 - UNDER 60 YEARS OF AGE.

If you are a renter under the age of 60 who, during 2014 had at least one dependent under the age of 18 living with you

AND you did not receive Federal or State housing subsidies or reside in public housing, AND the combined income of all

residents of your dwelling is below the following guidelines, you are encouraged to apply.

Persons in Household

2014 Gross

Persons in Household 2014 Gross

Persons in Household

2014 Gross

(Includes Applicant)

Income Limit

(Includes Applicant)

Income Limit

(Includes Applicant)

Income Limit

2

$16,057

5

$28,265

8

$40,484

3

$18,552

6

$31,925

9

$48,065

4

$23,834

7

$36,384

Note: If you qualify based upon the income limits above, the State will determine your eligibility using the formula

comparing rent and gross income.

EXAMPLE: George and Robin Smith, ages 34 and 33, have two dependents under the age of 18. The total

household income for 2014 was $16,200. In 2014 they paid $500 per month rent and they paid all their

own utilities. Since their income is below $23,834 (see Chart 2 on this page), the Smiths should apply

for the credit.

•

The rent in Chart 1 assumes that you pay all your own utilities separate from the monthly rent. If the rent includes gas,

electric or heat, you may need to have as much as an 18% higher monthly rent to qualify for a credit.

•

Trailer park residents are advised to submit an application and allow this office to determine eligibility.

•

Chart 1 is a guide only, and the exact amount of your income and rent will be used to determine your eligibility. If you

submit an application, the State will determine your eligibility.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4