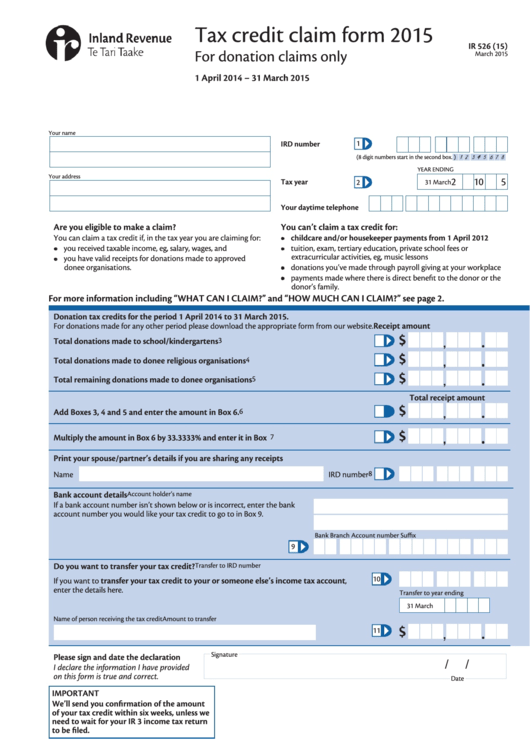

Tax credit claim form 2015

IR 526 (15)

For donation claims only

March 2015

1 April 2014 – 31 March 2015

Your name

1

IRD number

(8 digit numbers start in the second box.

)

YEAR ENDING

Your address

2

0

1

5

Tax year

2

31 March

Your daytime telephone

Are you eligible to make a claim?

You can’t claim a tax credit for:

You can claim a tax credit if, in the tax year you are claiming for:

• childcare and/or housekeeper payments from 1 April 2012

• you received taxable income, eg, salary, wages, and

• tuition, exam, tertiary education, private school fees or

extracurricular activities, eg, music lessons

• you have valid receipts for donations made to approved

donee organisations.

• donations you’ve made through payroll giving at your workplace

• payments made where there is direct benefit to the donor or the

donor’s family.

For more information including “WHAT CAN I CLAIM?” and “HOW MUCH CAN I CLAIM?” see page 2.

Donation tax credits for the period 1 April 2014 to 31 March 2015.

Receipt amount

For donations made for any other period please download the appropriate form from our website.

Total donations made to school/kindergartens

3

4

Total donations made to donee religious organisations

5

Total remaining donations made to donee organisations

Total receipt amount

Add Boxes 3, 4 and 5 and enter the amount in Box 6.

6

7

Multiply the amount in Box 6 by 33.3333% and enter it in Box 7.

Print new total here

Print your spouse/partner’s details if you are sharing any receipts

8

Name

IRD number

Bank account details

Account holder’s name

If a bank account number isn’t shown below or is incorrect, enter the bank

account number you would like your tax credit to go to in Box 9.

Bank

Branch

Account number

Suffix

9

Do you want to transfer your tax credit?

Transfer to IRD number

10

transfer your tax credit to your or someone else’s income tax account ,

If you want to

enter the details here.

Transfer to year ending

31 March

Name of person receiving the tax credit

Amount to transfer

11

Signature

Please sign and date the declaration

/

/

I declare the information I have provided

on this form is true and correct.

Date

IMPORTANT

We’ll send you confirmation of the amount

of your tax credit within six weeks, unless we

need to wait for your IR 3 income tax return

to be filed.

1

1 2

2