Meals Tax Form - Town Of Rocky Mount

ADVERTISEMENT

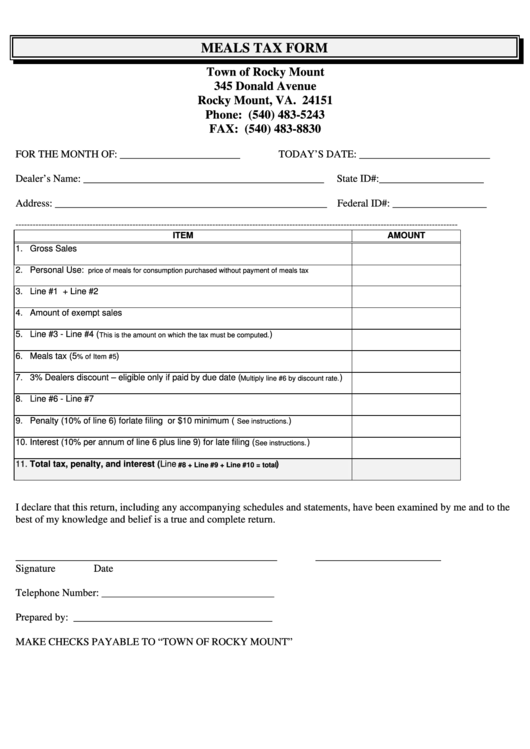

MEALS TAX FORM

Town of Rocky Mount

345 Donald Avenue

Rocky Mount, VA. 24151

Phone: (540) 483-5243

FAX: (540) 483-8830

FOR THE MONTH OF: _______________________

TODAY’S DATE: _________________________

Dealer’s Name: ______________________________________________

State ID#:____________________

Address: ____________________________________________________ Federal ID#: __________________

-----------------------------------------------------------------------------------------------------------------------------------------------------------

ITEM

AMOUNT

1. Gross Sales

2. Personal Use:

price of meals for consumption purchased without payment of meals tax

3. Line #1 + Line #2

4. Amount of exempt sales

5. Line #3 - Line #4 (

)

This is the amount on which the tax must be computed.

6. Meals tax (5

)

% of Item #5

7. 3% Dealers discount – eligible only if paid by due date (

)

Multiply line #6 by discount rate.

8. Line #6 - Line #7

9. Penalty (10% of line 6) for late filing or $10 minimum (

)

See instructions.

10. Interest (10% per annum of line 6 plus line 9) for late filing (

)

See instructions.

11. Total tax, penalty, and interest (Line

)

#8 + Line #9 + Line #10 = total

I declare that this return, including any accompanying schedules and statements, have been examined by me and to the

best of my knowledge and belief is a true and complete return.

__________________________________________________

________________________

Signature

Date

Telephone Number: _________________________________

Prepared by: ______________________________________

MAKE CHECKS PAYABLE TO “TOWN OF ROCKY MOUNT”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2