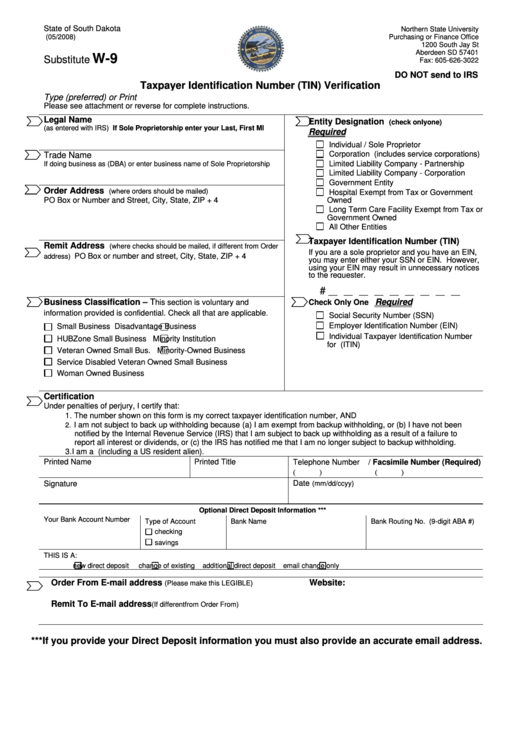

State Of South Dakota Substitute W-9 - Taxpayer Identification Number (Tin) Verification - Northern State University

ADVERTISEMENT

State of South Dakota

Northern State University

(05/2008)

Purchasing or Finance Office

1200 South Jay St

Aberdeen SD 57401

W-9

Substitute

Fax: 605-626-3022

DO NOT send to IRS

Taxpayer Identification Number (TIN) Verification

Type (preferred) or Print

Please see attachment or reverse for complete instructions.

Legal Name

Entity Designation

(check only one)

(as entered with IRS) If Sole Proprietorship enter your Last, First MI

Required

Individual / Sole Proprietor

Corporation (includes service corporations)

Trade Name

Limited Liability Company - Partnership

If doing business as (DBA) or enter business name of Sole Proprietorship

Limited Liability Company - Corporation

Government Entity

Order Address

(where orders should be mailed)

Hospital Exempt from Tax or Government

PO Box or Number and Street, City, State, ZIP + 4

Owned

Long Term Care Facility Exempt from Tax or

Government Owned

All Other Entities

Taxpayer Identification Number (TIN)

Remit Address

(where checks should be mailed, if different from Order

If you are a sole proprietor and you have an EIN,

PO Box or number and street, City, State, ZIP + 4

address)

you may enter either your SSN or EIN. However,

using your EIN may result in unnecessary notices

to the requester.

#

__ __ __ __ __ __ __ __ __

Business Classification – T

Required

his section is voluntary and

Check Only One

information provided is confidential. Check all that are applicable

.

Social Security Number (SSN)

Employer Identification Number (EIN)

Small Business

Disadvantage Business

Individual Taxpayer Identification Number

HUBZone Small Business

Minority Institution

for U.S. Resident Aliens (ITIN)

Veteran Owned Small Bus.

Minority-Owned Business

Service Disabled Veteran Owned Small Business

Woman Owned Business

Certification

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct taxpayer identification number, AND

I am not subject to back up withholding because (a) I am exempt from backup withholding, or (b) I have not been

2.

notified by the Internal Revenue Service (IRS) that I am subject to back up withholding as a result of a failure to

report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding.

3. I am a U.S. person (including a US resident alien).

Printed Name

Printed Title

Telephone Number

/ Facsimile Number (Required)

(

)

(

)

Signature

Date

(mm/dd/ccyy)

Optional Direct Deposit Information ***

Your Bank Account Number

Type of Account

Bank Name

Bank Routing No. (9-digit ABA #)

checking

savings

THIS IS A:

new direct deposit

change of existing

additional direct deposit

email change only

Order From E-mail address

Website:

(Please make this LEGIBLE)

Remit To E-mail address

(If different from Order From)

***If you provide your Direct Deposit information you must also provide an accurate email address.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3