701 Camino de los Marquez

Santa Fe, NM 87505

(505) 827-8030 (505) 827-1855

(505) 989-1338

fax

payroll fax

6201 Uptown Blvd. NE Ste. 204

Albuquerque, NM 87110

(505) 888-1560 (505) 830-2976

fax

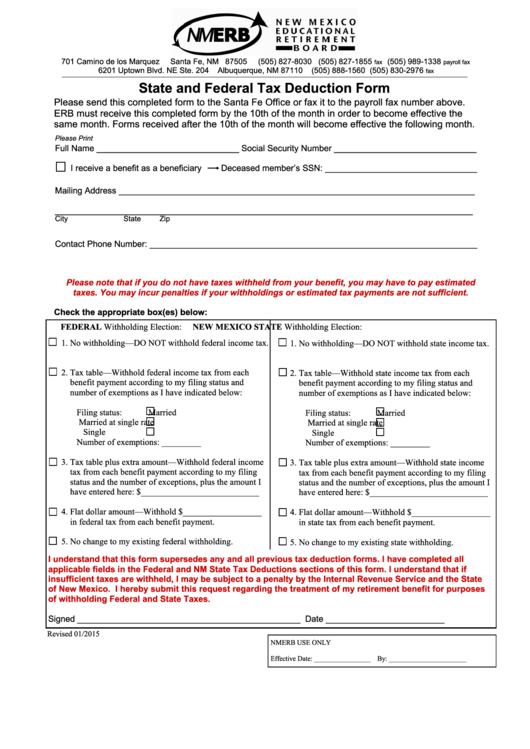

State and Federal Tax Deduction Form

Please send this completed form to the Santa Fe Office or fax it to the payroll fax number above.

ERB must receive this completed form by the 10th of the month in order to become effective the

same month. Forms received after the 10th of the month will become effective the following month.

Please Print

Full Name ______________________________ Social Security Number ______________________________

I receive a benefit as a beneficiary

Deceased member’s SSN: ________________________________

Mailing Address ___________________________________________________________________________

________________________________________________________________________________________

City

State

Zip

Contact Phone Number: _____________________________________________________________________

Please note that if you do not have taxes withheld from your benefit, you may have to pay estimated

taxes. You may incur penalties if your withholdings or estimated tax payments are not sufficient.

Check the appropriate box(es) below:

FEDERAL Withholding Election:

NEW MEXICO STATE Withholding Election:

1. No withholding—DO NOT withhold federal income tax.

1. No withholding—DO NOT withhold state income tax.

2. Tax table—Withhold federal income tax from each

2. Tax table—Withhold state income tax from each

benefit payment according to my filing status and

benefit payment according to my filing status and

number of exemptions as I have indicated below:

number of exemptions as I have indicated below:

Filing status:

Married

Filing status:

Married

Married at single rate

Married at single rate

Single

Single

Number of exemptions: _________

Number of exemptions: _________

3. Tax table plus extra amount—Withhold federal income

3. Tax table plus extra amount—Withhold state income

tax from each benefit payment according to my filing

tax from each benefit payment according to my filing

status and the number of exceptions, plus the amount I

status and the number of exceptions, plus the amount I

have entered here: $___________________________

have entered here: $___________________________

4. Flat dollar amount—Withhold $__________________

4. Flat dollar amount—Withhold $__________________

in federal tax from each benefit payment.

in state tax from each benefit payment.

5. No change to my existing federal withholding.

5. No change to my existing state withholding.

I understand that this form supersedes any and all previous tax deduction forms. I have completed all

applicable fields in the Federal and NM State Tax Deductions sections of this form. I understand that if

insufficient taxes are withheld, I may be subject to a penalty by the Internal Revenue Service and the State

of New Mexico. I hereby submit this request regarding the treatment of my retirement benefit for purposes

of withholding Federal and State Taxes.

Signed _______________________________________________

Date _________________________

Revised 01/2015

NMERB USE ONLY

Effective Date: ________________ By: ______________________

1

1